Hi Everyone,

In this edition of the Seifel Capital Newsletter we will analyze Unity Software Inc. (“U”, “Unity”, or the “Company”). It’s been a few weeks since our last report since I spent a lot of time passing on a few companies after being deep in the research process. However, David Perell (@david_perell) is one of the best writers out there and recommends publishing on a consistent basis. So, instead of waiting to finish each detailed company report, I will cover other topics for the weeks that a detailed company report is not ready.

Based on some feedback, I’ve changed the structure of the newsletter. The top will be the core of the report: 1) Executive Summary, 2) Company Overview, 3) Investment Thesis. The remainder of the newsletter will provide more details on the company and industry. I can’t stress enough the importance of knowing the details before investing, but I hope this structure makes the newsletter easier to consume! Additionally, I will look for alternative platforms to distribute this newsletter outside of substack since the formatting and functionality is not optimal.

I have become extremely fascinated by gaming / the “Metaverse” - writing this report gave me the opportunity to further develop a foundational knowledge on this subject. I hope to successfully and objectively convey what makes this theme so exciting for our society and markets. Most of what I have learned on this topic is from the work done by Matthew Ball (@ballmatthew; www.matthewball.vc), who I believe is the expert in this space. I am excited by the prospect of one day having domain expertise similar to what Matthew has - he is truly brilliant.

New Developments

I am thinking about expanding to additional platforms to advance my mission of democratizing investing knowledge (i.e. a YouTube channel). Stay tuned!

In addition to gaming / the Metaverse, I am focusing on three other major themes. I will be working on developing industry reports and better understanding of:

Artificial Intelligence / Machine Learning; and Semiconductors by extension

Alternative / Renewable Energy

Edge Computing

Please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

With that, please enjoy this report on Unity Software!

Investment Overview

Definitions - The following definitions will be useful to understand before reading this newsletter. More definitions will be introduced throughout:

Augmented Reality (“AR”): Uses digitally generated visual overlays to improve the real world.

Identifier for Advertisers (“IDFA”): A random device identifier assigned by Apple to a user's device. Advertisers use this to track data so they can deliver customized advertising.

Massively Multiplayer Online (“MMO”) Game: An online game with a large numbers of players, often hundreds or thousands, on the same server.

Mixed Reality (“MR”): The merging of real and virtual worlds to produce new environments and visualizations, where physical and digital objects co-exist and interact in real time. It is a hybrid of the real and virtual world.

Virtual Reality (“VR”): A comprehensive term for a multi-sensory, computer-generated experience that allows users to explore a virtual world and interact with it.

Executive Summary

Unity Software Inc. (NYSE: U) is one of two major players leading the transition from static content (long development cycles) to dynamic content (short development cycles) creation, enabling live feedback loops between content creators and users. While it was founded in 2004 as an open source shader-compiler (graphics tool) for Mac-based game developers, it has grown into one of the two leading platforms for creating and operating interactive, real-time, 3D (“IRT3D”) content in the world. The thesis is simple:

Unity will become one of the most important technology companies in the world, as the leading platform for building AR, VR, and MR applications in a highly digitized world.

This view is predicated on 1) the growing importance of AR and VR, and 2) the evolution of the Metaverse. Specifically, the Company’s technology will 1) remove existing frictions in the product development cycle, saving companies time and economic resources, and 2) serve as a foundational component of the Metaverse.

Unity will create value in the short-term through its leadership in Gaming, and through AR / VR applications across industries in the intermediate-term. If the Metaverse does succeed the Internet, Unity will become one of the leading technology companies in the world. Its leadership in mobile game development, in addition to its many alternative commercial use cases, makes Unity an interesting investment prospect even before the Metaverse materializes.

The decision tree for Unity is simple: do you believe we will all consume more immersive digital content in the future, where the real world and virtual world collide? It’s a question of optimism or pessimism, which leads to the decision to invest or not to invest. SCM has not provided a valuation in this report, as the potential value drivers cannot be quantified with any reasonable accuracy. Rather, this investment decision is binary based on our perception of the future; will we progress, or will we stagnate?

Company Overview

Unity was launched in Copenhagen by Nicholas Francis, Joachim Ante, and David Helgason in 2004. For simplicity, it was founded as a game engine with the mission of “democratizing game development, solve hard problems, and enable developer success.” Today, its mission is to enable more people to be creators in order to make IRT3D content ubiquitous - to be the “3D operating system of the world.”

“‘Engines’ are the foundational code upon which games, virtual worlds, and digital simulation run. These manage everything from the processing of decision logic, rules, and physics (e.g. the X button was pressed, so a bullet was fired, which traveled from point A to point B, hit player 2, etc.), to real-time visuals, sound production, artificial intelligence, memory and network management, and so forth. Every game requires an engine.” - Matt Ball

So, Unity’s platform provides the tools and technology that allow developers to create and produce virtual experiences without needing to engineer the code themselves. This is how Unity democratizes game dev; the users can focus simply on the creative aspect of their work, rather than having to worry about technical implications. In addition to gaming, Unity is slowly being adopted as a 3D design and simulation mechanism by other industries including film, automotive, and architecture. Unity is now used to create 60% of all AR/VR experiences. This may be why Facebook CEO, Mark Zuckerberg, argued in 2015 to acquire Unity since it was positioned as a key platform for the next wave of consumer technology after mobile.

As of June 30, 2020, Unity had approximately 1.5MM monthly active creators in over 190 countries and territories worldwide. The applications developed by these creators were downloaded over three billion times per month in 2019 on over 1.5B unique devices (Go ahead and let those stats sink in…). Check out this video if you would like to better understand Unity’s capabilities and value to developers.

Unity’s Story

Unity’s story as a game engine is important to understand why SCM believes it can execute on its mission. This article by Eric Peckham on TechCrunch does an excellent job narrating Unity’s evolution. Now, Unity estimates that in 2019, on a global basis, 53% of the top 1,000 mobile games on the Apple App Store and Google Play and over 50% of such mobile games, PC games, and console games combined were made with Unity.

The company’s evolution in gaming provides a template for expansion into additional industries: 1) Solve a niche problem, 2) Grow within niche user-base, 3) Expand upmarket to capture higher-end market.

Investment Thesis

Foundational Player of the Metaverse: Unity will capture an integral part of the Metaverse value chain, which is expected to be worth trillions in value.

“Epic is clear that Unity, their primary competitor for the game engine business, basically will have to be a foundational “founder” of the metaverse, by the nature of the fact that most of the world runs on, or most of the world's mobile games run on the metaverse. And if games are the starting point, then there's no way to back them out.” - Matt Ball

Sustainable Competitive Advantage (Moat): The high switching costs in time and resources to move from one engine to another gives Unity a competitive advantage with user retention. Digging a layer deeper - since it is less programming-intensive than Unreal, it is the preferred engine among students and more amateur professionals. Not only is it highly unlikely these users will move from Unity once they develop more technical knowledge, but it also provides a large talent pool for companies to hire from (in and outside of gaming), which will then use Unity to build its applications.

Customer Retention / Low Churn: This is the result of Unity’s moat. Not only has Unity exhibited extremely low gross churn, its growing DBNER (142% TTM) shows an impressive ability to cross-sell its expansive product suite to existing customers.

Engines are the Building Blocks of Digital Content: As a leading IRT3D engine, Unity’s expertise in dynamic content creation will ensure its importance across many industries. While uptake may be slower than anticipated, mixed reality will be a mainstay across industries, as well as professional and personal lives globally, for many years to come. Unity is positioned to enable the growth of this technology.

AR / VR Dominance: Stated above, Unity currently holds a majority of the AR / VR development market with the ability to distribute across platforms and operating systems. Facebook CEO Mark Zuckerberg has stated “VR / AR will be the next major computing platform after mobile.”

Zuckerberg believed mixed reality ecosystems would depend on Unity for “key platform services” when he was lobbying for Facebook to acquire Unity in 2015. Zuckerberg will probably be proven right here.

Unity should be able to extract value from a market expected to grow at a 63% CAGR to $571B by 2025.

By making its AR & VR platform easy to use for both professionals and non-professionals, Unity not only expands its potential user base, but also positions itself to be a key player higher up the tech stack of MR by providing a variety of solutions across content experiences including: payment processing, identity, and app distribution.

In-App Purchases: Unity does not currently take a revenue share from in-app purchases. Newzoo believes spending within mobile games is a $77B market growing at 13% per year. As the leader in mobile game development, Unity has an opportunity to create a multi-billion dollar business from IAP by continuing to improve its offering and then monetizing.

You can do some quick math: $77B market * 53% market share = $40.8B opportunity * 5% (conservative) take rate = $2B / year in revenue.

Note that Unity already provides these services, so most of this revenue should fall to the bottom line.

Advertising / Monetization Runway: No matter which TAM estimates you use in the Advertising industry overview below, its evident that Unity’s monetization products have significant growth potential. While Apple’s IDFA changes being rolled out next year will have an impact on most ad networks, it shouldn’t have much of an impact on Unity since it targets ads based on the “contextual” (within the game) behavior of a user. The mobile game advertising market growth potential provides a huge opportunity for Unity.

Put simply, this change will begin requiring users to opt in for developers to access their devices’ advertising ID, or IDFA. Essentially, a user will get a pop-up asking if they will grant the application permission to track the user across other apps and websites in order to deliver personalized advertising. One Forrester analyst expects 70% of iPhone users not to opt in.

Gaming Growth Provides Sustainable Bridge to AR/VR: Despite its large market share, mobile gaming will still provide a tailwind for Unity. It has the opportunity to grow Create Solutions revenue due to greater technical capabilities (grow within bigger studios), and more specifically Operate Solutions, as the games developed with Unity continue to generate more revenue. Data provided by App Annie shows an industry still in the early stages of its growth profile.

Mobile Games Generating +$5MM Revenue: 959 (2017), 1,055 (2018), 1,121 (2019) - 8.1% CAGR

Mobile Games Generating +$100MM Revenue: 88 (2017), 116 (2018), 140 (2019) - 26% CAGR

Technological Advancements: Unity is sacrificing short-term profits by investing heavily into R&D to make its platform 1) easier to use and 2) enable more customization and higher fidelity graphics. This would attract more non-professionals and professionals. While Unreal Engine has served as the leading engine at the top of the gaming market, Unity’s DOTS technology is its attempt to provide a similar experience and product for developers. While this won’t cause developers to move from Unreal to Unity, it is certainly an important move as Unity attempts to be the dominant player in AR & VR software outside of gaming. Unity’s platform is now equipped to handle the performance and customization needs of developers.

As a friendly reminder, feel free to share the newsletter or subscribe if you enjoyed this summary report. If you want a more holistic understanding of Unity and the industry, read on!

Investment Details

Product Overview

Starting with a high level overview of the platform:

It is a robust software development engine to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and AR & VR devices.

It provides a suite of technologies, configurable through the Unity editor user interface, including custom scripting tools, a high-definition render pipeline, graphics, animation, and audio tools, navigation, networking and user interface tools.

Editor enables creators to drag and drop content, such as images, textures, 3D meshes and sounds, into a virtual workspace. From there, creators can configure content and compose it into scenes of objects, such as three-dimensional characters, buildings, automobiles or landscapes.

Deployment: Platform compiles all of the application’s components around the Unity runtime. The Unity runtime allows content created on the platform to be interactively rendered in real-time on end-user devices. This is how content created in the editor can be easily deployed to over 20 platforms using the runtime.

Content built on the Unity platform offers end-users a more engaging and immersive experience than traditional static content.

Interactive: Allows end-users to connect with the content and one another

Real-Time: Allows instant adaptation to end-user behavior and feedback

3D: Permits multiple viewing angles, enabling AR/VR

Here is the key to the intermediate-term thesis: real-time is not just a part of the end-user experience. Building content on Unity offers creators significant advantages in development compared to traditional content creation tools. Creators can visualize and iterate on their 2D and 3D creations in real-time and collaborate with each other to edit content simultaneously. This can lead to significant reductions in design and development cycle times.

Create Solutions: Used by content creators (including developers, artists, designers, engineers, and architects) to create IRT3D and 2D content.

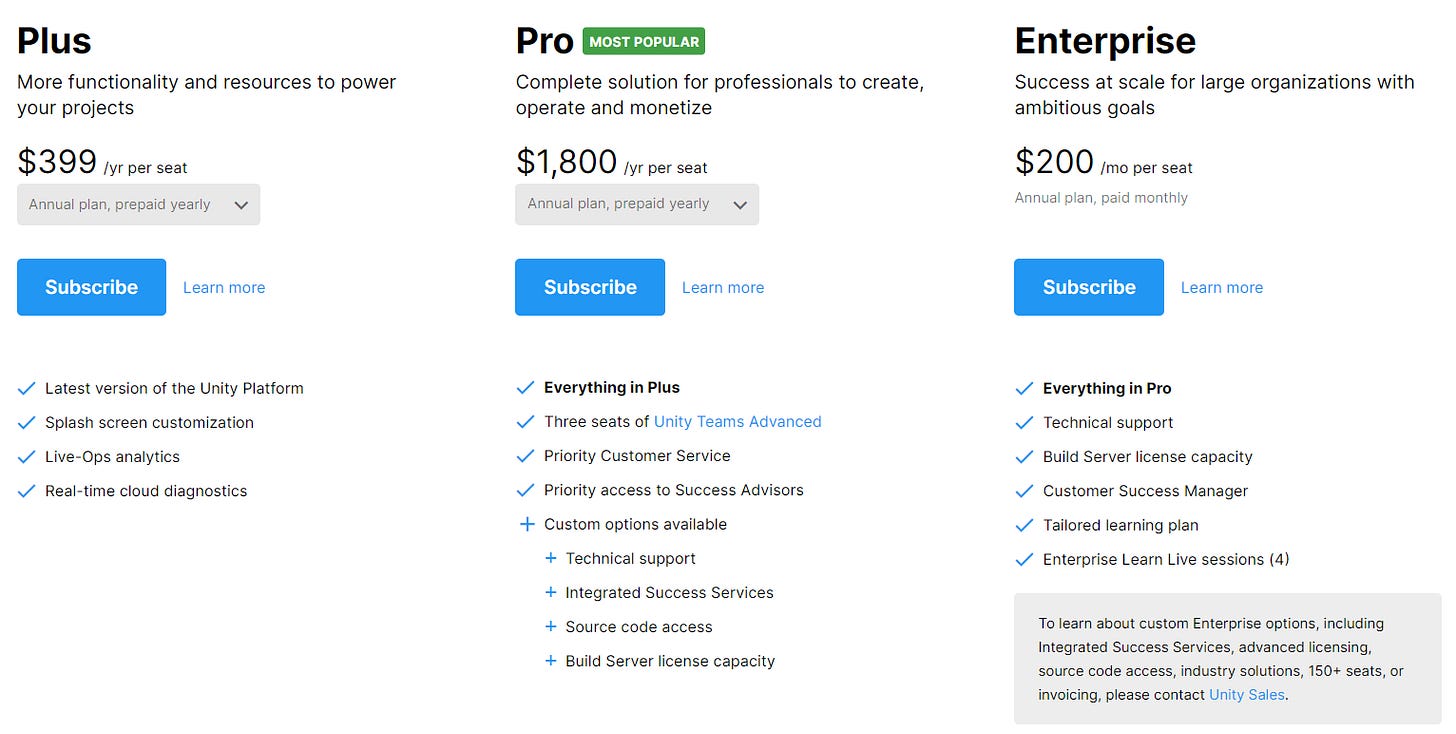

Unity Platform: The core game engine, which operates on a “freemium” subscription model.

Assisted Artistry Tools: Use machine-learning algorithms to accelerate material creation and editing, including: ArtEngine (3D content creation tool) and Granite (advanced texture system for content).

Industry Agnostic Tools: Including Reflect Accelerator (Unity engineers help build RT3D apps), MARS (create intelligent AR experiences that fully integrate with the real world), Unity Forma (Product configuration toolkit), Cinemachine (used for virtual production of games and films), and Pixyz (import, prep, and optimize files for real-time visualization in Unity).

Professional Services: White glove consulting for enterprise customers.

Unity acquired Finger Food Studios in April 2020 for $55MM to expand its consulting capabilities further. Finger Food Studios was a 200-person team in Vancouver that builds interactive media projects for corporate clients using Unity.

Strategic Partnerships: Major tech companies pay Unity to create and maintain integrations with their software and/or hardware. Its critical for these companies that Unity’s platform integrates well with with their offerings since Unity is the most popular platform to build games with. This is a key part of Unity’s distribution and go-to-market (“GTM”) strategy, with partners including: Apple, Autodesk, ARM, Google, Intel, Microsoft, Nintendo, Samsung, Sony, and Tencent.

Unity Asset Store: Unity’s marketplace is a central repository of digital assets created by artists and developers for each to buy and sell. The benefit for users is expediting content creation rather than building everything from scratch. Digital assets can include anything from car parts to an eyebrow raise.

Operate Solutions: Enables customers to grow and engage their end-user base, as well as run and monetize their content with the goal of optimizing end-user acquisition and operational costs while increasing the lifetime value (“LTV”) of their end-users.

Advertising: Unity launched its in-game advertising network for mobile games in 2014 with its acquisition of Applifier. Unified Auction is Unity’s simultaneous auction platform that helps games get the highest bid among potential advertisers. These two tools have experienced staggering growth, as Unity is now one of the world’s largest mobile ad networks, serving 23 billion ads per month.

Personalized Advertising: End-user acquisition product that uses machine learning combined with player and game data to drive end-user installs at scale. Advertisers can define campaigns based on several parameters: Reach, Retention, and Desired Return on Ad Spend (“ROAS”).

Contextual Advertising: Product designed for when customers or end-users opt-out of personalization within apps. Unity can still deliver highly relevant advertising while respecting stricter privacy elections due to its breadth and depth of in-game data.

Unity also has real-time monetization tools to help its customers generate revenue. These tools help determine whether it is optimal to 1) serve an ad, 2) prompt an in-app purchase (“IAP”), or 3) do nothing, all in an effort to maximize each player’s LTV.

End User Engagement (“Live Ops”): Unity provides a broad offering of cloud-based solutions for game developers to better manage and optimize their 1) user acquisition, 2) player matchmaking, 3) server hosting, and 4) identification of bugs. This portfolio has primarily been assembled through value-add acquisitions:

deltaDNA: Player segmentation for campaigns to improve engagement, monetization, and retention.

Multiplay: Provides server hosting and matchmaking in the cloud.

Vivox: Cloud-hosted platform for voice and text chat between players in games.

Unity Simulate: Product for training AI models in virtual recreations of the real world or testing games for bugs.

Business Model - How does the Company make money?

Create Solutions: Revenue is generated mainly through the sale of subscriptions to its platform products and related support services. Additionally, Unity enters into mostly fixed-fee contracts for professional services with larger enterprise customers to assist them in creating content and applications.

Customers typically purchase subscriptions for 1-3 year terms, billed in monthly, quarterly, or annual installments.

Independent creators and smaller studios typically subscribe to plans with a one-year term that are billed monthly.

The majority of subscription fees are billed in advance, resulting in deferred revenue on the balance sheet for unearned revenue. This deferred revenue is recognized ratably over the subscription term.

Operate Solutions: Revenue is currently mainly generated under a revenue-share model. The remainder is generated through a usage-based structure.

Revenue is dependent on the popularity and timing of customer’s games and applications, in addition to the customer’s strategy for increasing the LTV of their end-users.

This model creates alignment between Unity and its customers, as revenue is directly proportional to customer success measured by end-user usage of their games and apps.

Allowing customers to join the platform early in their product development cycle through self-serve channels and with minimal upfront investments, they are able to quickly and easily scale their usage of Unity’s products and services as their business grows.

Usage-based revenue primarily comes from deltaDNA (# of active users), Multiplay (based on a customer’s hosting needs: storage, compute, processing, and bandwidth), and Vivox (based on the number of peak concurrent users in any given month).

Strategic Partnerships and Other: Partnership agreements are based on the specific needs of each partner and range from deep technology collaborations and development services agreements to co-marketing and revenue share arrangements. The majority of revenue-generating strategic partnership agreements involve fixed-fee service arrangements relating to development and integration services to enable creators to deploy their games and applications on partners’ platforms.

Distribution Model and Go-to-Market (“GTM”)

Direct Sales: Used primarily to acquire enterprise customers and increase the adoption of existing products and services. Made up of 1) Inside sales, 2) Customer success, and 3) Field engineering.

Technical professionals help customers complete and facilitate the content development and deployment process.

Digital Channel: To attract independent creators, SMBs, and independent studios through a self-service digital model. Customer acquisition is enhanced by the freemium model, in which this cohort can utilize Unity’s Create Solutions for free until it reaches $100K in business.

These customers generate revenue for Unity through Operate Solutions, which is primarily a self-service platform.

Most of Unity’s users have free accounts, which indicates future revenue opportunities through the conversion to paid accounts.

While these accounts don’t provide immediate economic value, this cohort helps build Unity’s brand awareness throughout the developer community.

Customer Support & Community Building: Forums, Answers, and Documentation

Strategic Partnerships: Unity’s partner ecosystem was discussed above.

Growth Opportunities - Existing Business Lines

Product Innovation: The Company’s R&D investments are focused on adding features, automation, visualization, collaboration, and experiential capabilities to to Create Solutions. This expands the number of use cases for its products.

Example: Recent launch of Unity MARS, which helps creators build, prototype, and visualize AR/VR applications in real-time.

Existing Customers

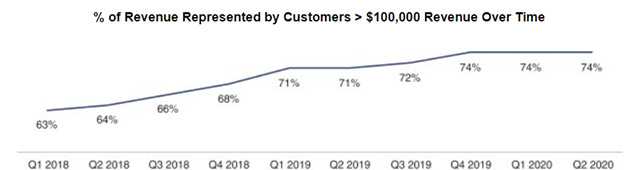

Unity has grown its enterprise customer base (> $100K Revenue) from 389 to 716 from Q1 2018 to Q2 2020, a 27.6% compound annual rate. Unity defines a customer as “an individual or entity that generated revenue during the measurement period.” So, even if a company like Zynga buys subscriptions for 50 different game developers, it counts as only one customer.

Unity is already the market leader in game engines. It has over 100,000 gaming customers, and 93 of the top 100 game studios by revenues are already Unity customers. While the company has experienced impressive growth in enterprise customers, attracting more of these customers likely won’t be the main growth lever moving forward.

Instead, look for customers currently generating less than $100K in Revenue to grow into this cohort.

Create Solutions: Increase the number of subscriptions by capturing more business from existing customers using more than one game engine; which is only really possible for games starting development.

Subscription growth occurs by expanding within and across multiple studios within a single publisher.

A difficulty here is that of the top 50 grossing iOS games in the U.S., only six were released in the last two years. This means studios are focusing more on growing existing games rather than starting new games. SCM believes Unity’s ability to increase Create Solutions revenue by adding new Gaming customers is limited. However, this dynamic also means it is likely that more of Unity’s non-paying customers will grow into being paying customers.

Operate Solutions: Success of customer games and apps is the core growth driver. Unity’s strong and growing portfolio of products enables cross-selling of tools to increase the number of solutions customers use, as well as overall usage.

Customer usage grows along with end-user adoption and engagement. So, Unity generates more revenue when more of the customer’s users view ads facilitated through Unified Auction, communicate using Unity voice products, and spend time in the games and applications Unity hosts.

Organic growth potential is evident: as a proportion of Create solutions revenues that come from customers who spend over $100k a year, only 33% was from customers who also use Operate solutions.

Of course, the aforementioned point that growth of existing games has been the focus of studios bodes well for Operate Solutions revenue. Specifically, there will be increased demand for Unity’s Live Ops portfolio, so that studios can better understand player trends and focus on consistently rolling out new updates and features to enhance user engagement. This growth would be nearly 100% margin accretive.

Only 55% of customers that contributed more than $100,000 in trailing 12-month revenue used both Create Solutions and Operate Solutions. Increasing cross-sell over time will be a natural revenue tailwind.

Success of existing customer growth can be tracked by the dollar-based net expansion rate (“DBNER”). DBNER grew from 124% to 133% to 142% as of Q4 2018, Q4 2019, and Q2 2020, respectively.

New Gaming Customers

Unity’s opportunity to attract new gaming customers comes from driving studios away from proprietary tech stacks and on to Unity’s platform.

Unity’s freemium model allows the Company to develop a pool of potential new customers. Converting free users to paid is of strategic import to Unity. Free usage by students and hobbyists allows them to learn the engine before requiring a paid subscription. They are the next generations of Unity creators because they are unlikely to go to a new engine in which they’d have to learn an entirely new system.

Growth in Industries and Use Cases Beyond Gaming

Industries: Architecture, engineering, construction, automotive, transportation, manufacturing, film, television, and retail.

Use Cases: Customers in these industries leverage Unity’s platform to create content across many new use cases including AR product configurators, AR workplace safety training, automobile and building design, infotainment and autonomous driving simulation, and more. These use cases will improve 1) product development cycles and 2) consumer experiences. Specific use cases include:

Training: Companies can use IRT3D content for workers to develop expertise in managing risky work environments.

Simulation: As an example, Google’s DeepMind and Unity partnered with LG to create a simulation module around autonomous vehicles.

Design & Planning: Architectural teams can now build 3D interactive models simultaneously to expedite workflows, while also being able to tag parts of the project with important notes or data.

Sales & Marketing: While digital marketing is becoming more popular in Asia, Unity’s engine can be used to create IRT3D experience for shoppers to try on accessories or clothing, while also being able to change lighting and other environmental features.

Unity Investments: R&D investments are being made to enhance its existing core gaming technology with industry-specific workflows and features. Additionally, Unity is building out its S&M programs to fuel growth in these market segments.

Unity is well positioned to capture the growth in usage of RT3D and AR/VR that is emerging in other industries. However, the cost of growing outside of gaming is very high since Unity doesn’t have as strong a brand presence and sales cycles are longer and intensive.

SCM believes Unity’s growth driver will come from industries outside of gaming, due to its already large market share in the space. While timing remains a key question, end-users will require IRT3D content and experiences across many facets of their lives.

Example Use Case: Unity’s engine can be used for virtual production in films and TV commercials. Settings can be either animated or scanned from real-world environments. The settings are then set up as virtual environments, so that cinematography and virtual character interactions can be changed instantaneously. The production team (including the director) can change the environment (i.e. landscape, lighting, etc.) in real-time to find the perfect shot. Check out this video to see some of Unity’s capabilities.

Finally, Unity will serve as a foundational element of the buildout of the Metaverse. Serving as a core component of the Metaverse value chain will create immense economic opportunity for the Company that cannot be currently estimated with any amount of legitimacy.

Industry Overview

Modern media content has largely been created by simply capturing 3D images through a 2D lens and projecting them onto a 2D surface. Even recent content creation technology is based on building 2D, asynchronous, non-interactive, static content. But there is a paradigmatic shift occurring in the industry driven by key technological developments. Gaming is the first industry to benefit from this progress, growing from less than $15B industry 20 years ago to one generating over $140B in annual revenue today. It is now the fastest growing media category with over 2.5B gamers worldwide (32% of the 7.8B global population).

Current Market Opportunity

Unity’s view of its market opportunity is detailed in its S-1:

The total addressable market (“TAM”) for Create and Operate Solutions: $29B across both gaming and other industries.

Gaming: Grow from ~$12B in 2019, across over 15 million potential creators, to over $16B in 2025.

Industries Beyond Gaming: ~$17 billion currently, based on the number of software developers, architects, and designers that Unity’s solutions could potentially serve.

Market Segment Overview

Gaming: Unity is investing in R&D to bring new solutions to market that will expand the applicability of its platform to creators, such as assisted artistry workflows, higher performance rendering capabilities, and additions to its Operate Solutions.

AR & VR: As the leading platform for creating content for AR & VR applications, Unity will be a direct beneficiary of larger opportunities in the future that result from innovations in hardware and connectivity increasing capability and drive adoption.

Industries Beyond Gaming: The potential user pool of current and future products consists of 37MM engineers and technicians globally (source: Cambashi, April 2019).

Secular Trends

Technology Enabled Development of IRT3D Content: Creators are now able to develop immersive, interactive content in real-time due to the following technological developments:

Compute Power: Moore’s Law (processing capabilities double every two years) and Wright’s Law (costs fall by constant % when cumulative production doubles) have led to low-cost PCs and mobile phones being able to run IRT3D content. The underlying drivers are advancements in graphics processing units (“GPUs”).

Platforms and Devices: Easy and affordable access to IRT3D content through a variety of platforms and devices with increasing capabilities are a major demand driver. As an example, the ability of devices to enable AR & VR to consume IRT3D content will drive demand for more of such content.

Distribution: Streaming and cloud-based content delivery have replaced the traditional physical forms of distribution, making content available on-demand and lowering barriers to entry.

Connectivity: Access to high-speed connections continues to grow, which will be fueled by the proliferation of 5G wireless technology. End-users are able to interact with each other on platforms providing IRT3D content.

Real-Time 3D Applicability Across Industries: Game developers were early adopters of many of the technological innovations mentioned above in order to deliver the best gaming experiences to end-users. Mobile gaming experienced massive growth as a result. Gamers continue to embrace the most innovative user experiences, gameplay or graphics, or the most interactivity. It follows that game developers will be early adopters of real-time 3D in order to execute on the desires of gamers.

Making these technologies available to smaller studios and independent developers will further democratize game development and it will compound the success of real-time 3D by enabling the growth of a large, real-time 3D development community.

A larger 3D development community will enable growth into a variety of other industries including commercial content and personal media. End-users experiencing the value of interactive, real-time 3D content will increasingly expect similar immersive, interactive experiences across industries. These industries include automobile and building design, online and AR product configurators, autonomous driving simulation, and AR workplace safety training, etc.

Gaming Market

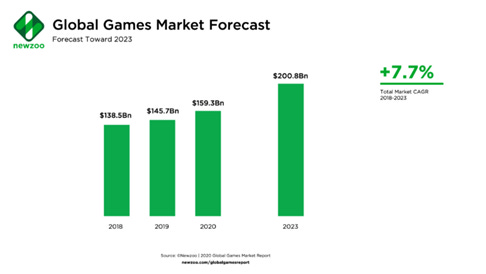

Newzoo, a games and esports analytics company, forecast that the 2020 global games market will generate revenues of $159.3B (+9.3%) in its Global Games Market Report. While the industry benefited from COVID-19 lockdowns, the launch of next-gen consoles toward the end of the year is also a key contributing factor. Geographically, nearly half of all spending on games will come from the U.S. and China, with LatAm and APAC contributing to future growth.

Mobile Market: Mobile games are expected to generate $77.2B of revenues in 2020 (+13.3% YoY), as the gaming segment benefitting most from the lockdowns. There are a few core reasons for mobile’s outperformance of both PC and consoles:

Low barriers to entry: More than 40% of the global population owns a smartphone. However, there are also low barriers to exit; a slowdown in penetration is something to watch for once lockdowns are lifted.

Cheap alternative: As mentioned above, the industry has moved to a “free-to-play” model

Safety: PC cafes were negatively impacted by the lockdowns.

Development process: The mobile development process is less complex and, therefore, less likely to suffer delays from COVID-19-related disruption.

Engagement for mobile games is expected to rise even more rapidly, which SCM believes is a huge tailwind for Unity’s ad business. Only 38% of the expected to 2.6B mobile gamers in 2020 will pay for games.

Console Market: Expected to grow by 6.8% YoY to $45.2 billion with over 729 million players. Game delays or product changes could result due to the physical distribution, massive cross-company collaboration, and certification aspects of console game development.

As Newzoo states, “In Q2, PlayStation 4 exclusives The Last of Us 2 and Ghost of Tshushima were already delayed due to distribution issues (resulting from the pandemic). Even ported games are affected, with Switch ports of The Outer Worlds and The Wonderful 101: Remastered also receiving COVID-19-related delays.”

PC Market: Revenues grew by 4.8% YoY to $36.9B in 2020 driven by its 1.3B players. This growth can be almost fully attributed to the lockdown measures.

The global gaming market is forecast to reach $200.8B by 2023, growing at an 8.3% CAGR. With 2.5B mobile players in 2020, the mobile gaming population is also expected to be the fastest growing cohort of gamers. Mobile games are expected to continue to be the fastest growing segment overall.

The following trends are expected to drive gaming growth (charts provided by Morgan Stanley and Newzoo):

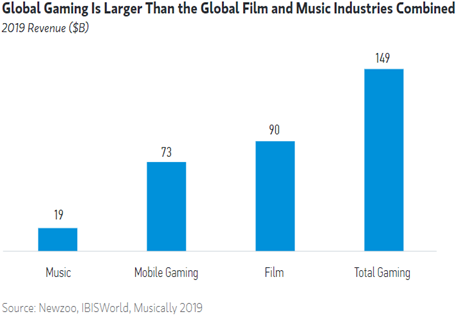

Dominant Entertainment Medium: Growth in consumer spending on video games (ex-hardware) has grown at a 9.4% compounded annual rate over the past 15 years, from $35B to $135B currently. The size of the global video game industry is now larger than global film and music combined. Additionally, roughly one-third of the global population says they play or watch video games and eSports is already one of the most popular sports in the world.

Developments on Ways to Pay, Play, and Engage: The “free-to-play” model discussed above is accelerating gaming adoption. Investors claiming the industry is “hit-driven” miss the mark. These gaming publishers have durable franchises and predictable streams of free cash flow.

From Morgan Stanley: “Current and future growth drivers include new ways to play (multi/cross platform, streaming), pay (full price, free-to-play, and subscription) and engage (esports and live streaming), which MSIM estimates will result in double-digit industry sales growth globally through 2025. Furthermore, high levels of player engagement within global gaming franchises, the opportunity for operating leverage as businesses increasingly transition to a recurring-revenue subscription offering, and the vast opportunities in mobile gaming, particularly in the emerging world, only enhances the industry’s appeal.”

While the move from physical to digital distribution plays a role, the increasing dominance of in-game revenues (from IAP) will shrink even full-game digital revenues in the coming years. Note that the free-to-play model relies on in-game revenues.

Free-to-play is the dominant monetization model for mobile and PC gaming, and it is quickly changing how console games are monetized. IAP make up largest portion of mobile gaming revenues by a wide margin, making publishers less reliant on “hit games.”

Monetization Opportunity and Runway: Matt Ball provides some excellent statistics in his interview with Patrick O’Shaughnessy, summarized as:

On an hourly basis, video games are still monetizing at fractions of what standard cable television (or live sports per ClearVoice Research) is on an hourly basis, which makes very little sense when you compare the degree of immersion and focus of the audience. There will be big leaps in the monetization of gaming moving forward.

There are 2.1 billion leisure hours per day in the United States. Today 75% of that is television and 50% of TV is 50+ age group. Percent of time spent on gaming is much, much higher in Gen X and Gen Z, so will see shift in how leisure hours are being spent.

If the evolution of internet advertising is any indication, it is no surprise that gaming monetization penetration has been slow. However, its growth is inevitable. Mobile gaming presents a variety of attractive opportunities that make the industry appealing to advertisers. Despite this appeal, the most well-known (AAA) games still only monetize at a rate of 65% of the average cable channel and roughly 25% of live sports on a per hour basis.

As Matt Ball has argued, which will be further discussed below, game-makers are seeking to become the foundation layer of the metaverse. The metaverse represents a whole new set of new monetization opportunities.

Technology Developments: Global smartphone proliferation along with the buildout of 5G networks and cloud-based infrastructure has fueled rapid growth in mobile gaming, allowing the industry to scale rapidly at a low marginal cost.

Online gaming services, digital stores for distribution of games, and broadened access to the array of digital content available are all developments embraced by major gaming companies.

Global Internet platforms can leverage their scale and resources to create viable game-streaming businesses (read this article by Ben Thompson about Facebook’s move into the space).

Growing smartphone penetration rates across emerging markets have resulted in mobile gaming claiming 45% of the total games market with $65B revenue in 2019. This represents a 10% increase over 2018, according to App Annie.

Mobility remains a key growth driver in emerging markets, which will benefit from improved connectivity through 5G networks.

Summary: New monetization models like subscriptions, audience/spectator micro-transactions, and cloud-gaming will capture a broader potential user base previously unavailable to publishers. Technological innovation and advancements will improve gaming quality and distribution, making games available to segments of the population that could not be reached previously.

Games like Roblox and Minecraft are engaging younger audiences early on with the focus of not just having them “consume” content but allowing them to also “create” and “remix” it. The majority of gamers are still younger users that are expected to continue gaming as they age. This will provide advertisers the opportunity to expand to new forms of media, including esports, video streams, and the games themselves. Gaming monetization has a long runway left, as it is currently discounted compared to other media channels that don’t have nearly the same engagement that gaming has (i.e. television).

AR & VR

AR and VR technologies are used to provide a digital immersive user experience. These technologies have a growing variety of applications in entertainment and business.

The global AR & VR market is expected to grow from $11.35B in 2017 to $571.42B by 2025, reflecting a CAGR of 63.3% between 2018 and 2025. Growing smart device penetration around the world is a key driver of this remarkable forecasted growth rate. What may temper growth are the lack of effective user experience designs and the slow adoption among underdeveloped economies.

Hardware: The Head Mounted Displays (“HMD”) market is expected to grow from $6.1B in 2016 to $160B in 2023, a 78.3% CAGR, according to IDC.

Key Trends

Proliferation of Consumer Electronics: Some of the items discussed above in Gaming will be the main drivers of AR & VR growth. Mobile gaming, increase in internet connectivity, and overall progress in the animation and video game industry are some of the key drivers of the global AR & VR market.

5G network speeds of 3 gigabits per second could enable AR/VR streaming from the cloud. While data transfer speeds and low on-device processing power has been a hurdle for the industry’s growth, the cloud and 5G technology will remove these frictions for VR & AR designers. The result will be cheaper headsets and viewing devices and more realistic VR simulations.

Removing Product Development Frictions: AR & VR provides a cost-effective and efficient solution for training and skill development by creating actual scenarios, that can be repeated, in a safe environment.

Military and civil aviation training are two of such examples that are currently costly but could become drastically more efficient with AR & VR.

Medical training provides another great opportunity for AR & VR to enable better training without ethical or expense implications.

Digital Transformation: Technology is transforming many industries in which AR & VR may not be applicable yet. However, expansion across these industries will prove meaningful for the overall market size of AR & VR once other technologies catch up.

Expansion Beyond Gaming & Entertainment: While gaming and entertainment have proven to be early adopters, the 2020 XR Industry Insight report (VR Intelligence) states that 65% of the AR companies surveyed are working on industrial applications, while just 37% are working on consumer products and software.

Education: AR will improve on-the-job training while VR will allow students to learn in more immersive and creative ways. While VR can already provide unique niche experiences (i.e. visiting the Renaissance), it will solve current frictions and issues with the current educational structure.

Aesthetic Design: AR can be used for a wide variety of design / prototype concepts. Some examples include interior design ideas, trying on accessories (i.e. watches, glasses, etc.), measuring appropriate sizes for products (i.e. clothing, furniture, etc.), and so much more.

Real Estate: VR can create property tours and expedite the real estate sales cycle.

Engineering: The implementation and development of VR will increase efficiencies by reducing model design time by 10%, and construction time by 7%.

Hardware Improvements: Bulky hardware has proven to be more of a problem with VR since the powerful processing hardware needed to generate graphics is usually contained within the headset.

More powerful processors will enable hardware to be more mobile and produce higher quality graphics.

Upcoming development: Apple’s forthcoming 8K combined VR/AR glasses that will be “untethered” from a computer or phone.

Current Applications

Manufacturing: VR is being used to enhance the design of vehicles and other major durable goods. Prior to VR, companies had to build physical samples of these durable goods to determine how they could adjust the design to improve functionality. Think about the exorbitant amount of R&D expenditures that has gone into this process.

Present Day: Companies can now make real-time adjustments using virtual representations of its products, and test adjustments as if they were actually using them before manufacturing even begins. This will increase firm profit capture through drastically reduced R&D spend and increased bandwidth (saved hours).

Training and Education: Some industry experts predict that training and education will be the most impacted by virtual reality, which can already be seen.

Google’s Pioneer Expeditions allows teachers and students to “travel to” more than 100 locations, including the Great Wall of China, coral reefs, and even Mars. Hands on learning will improve the overall learning experience.

This can be extrapolated to trade schools, in which students will be able to learn their craft through VR experiences.

Healthcare: Doctors and researchers can create realistic 3D models of the human anatomy based on ultrasound, CT scans, and other forms of diagnostic imaging. Surgeons can use these 3D models to devise and practice medical procedures, advancing medical capabilities, improving patient outcomes, and reducing treatment costs across the system.

VR is also being used to treat dementia patients and rehabilitate stroke victims and others who have experienced traumatic brain injuries (“TBIs”).

The Healthcare VR market is expected to grow at a 38% CAGR through 2025.

Gaming: VR has completely altered the gaming industry, which comes at no surprise since it was the earliest adopter of VR tech. The gaming industry first started adopting VR in the 1990s when the technology was primitive (at best) and didn’t create an immersive experience for users. Today’s VR technology that’s used in video gaming is lightweight, easy to use, easy to access, and creates a real life-like experience.

The big difference between the use of current and former VR technology is that companies today are focused on offering completely new experiences, rather than just enhancing their current platform.

VR increases end-user engagement through the immersive experiences, making games itself more easily monetized.

Other Key Stats: I encourage you to check out this article, which will drive home the staggering expected growth of AR & VR.

It’s estimated that 171MM people worldwide used VR in 2019

Global VR video gaming revenues are expected to reach $22.9B in 2020

14MM AR and VR devices were sold in 2019

It’s expected that 68.6MM VR & AR devices will be shipped in 2023, including over 30MM headsets

Summary: Unity’s engine will span across industries for creating IRT3D applications. This means the $17B TAM (and economic potential) for “Industries Beyond Gaming” drastically underestimates what will be available to Unity. A big advantage Unity has is in advertising, as it is already able to produce AR ads within apps built with its engine. While the development and buildout of a fully functioning AR computing platform is still many years away, Unity is positioned to become the largest ad network in this eventual paradigm.

That leads to a risk that investors should be aware of. This thesis will take time to play out, as evidenced by the slow uptake Unity has experienced with customers outside of Gaming. An important trend to watch is Unity’s market penetration within the space.

Advertising

The financial overview below will clearly show how Unity has become a major advertising business, with significant potential to grow within the space.

Fortune Business Insights projects that the global mobile ad market was worth $44.1B in 2018 and will grow at a 32.5% CAGR to reach $408.58B by 2026. MarketWatch reports that the market was worth $66.6B in 2019, representing 49.1% YoY growth. As an additional data point, Statista estimates that the mobile ads market is currently with $200B growing at a 14.3% CAGR.

Smartphone proliferation, due to decreasing costs and improving connectivity (i.e. 5G), is transforming how people socialize and communicate, which will drive growth in the ad space. The growth of consumer facing applications will serve as a channel through which brands can market to end-users.

44.9% of the world’s population is expected to own a smartphone by the end of 2020.

Global smartphone shipments are projected to add up to around 1.48 billion units in 2023.

There are an estimated 3.2B smartphone users today, expected to grow to 3.8B by 2021.

Location-based technology will enable advanced levels of customer service and opportunity. The resulting data aggregation will improve ad spend efficiency and in turn, promoting more ad spend.

A potential headwind, which exists today, is privacy concerns.

The market is grouped by: 1) banner ads, 2) video ads, 3) mobile rich media, 4) in-app ads, and 5) others.

In-app ad segment (think Unity) is expected to experience the highest growth resulting from its increased adoption by advertisers worldwide.

Video ads comprised 25.0% of the mobile advertising market share in 2018, which is expected to increase along with increased smartphone penetration.

The next evolution of mobile ads is expected to include a variety of new formats such as vertical videos, 360-degree video, and AR & VR supported videos.

In-game advertising, specifically, is emerging as a preferred medium for advertisers; this was bolstered by the 59% increase in mobile games ad revenue after the pandemic started.

In-game ads is currently a $3B market, however it does not attract many different cohorts of advertisers. This will change over time as advertisers begin to realize the efficacy of these ads.

Other mobile games are the biggest players in the mobile game advertising market.

It stands to reason that mobile game advertising has a lot of growth potential once other industries realize the efficacy of advertising through this channel to reach highly engaged users.

The Metaverse

The majority of information presented here is collated from the work of Matt Ball; these resources will be included at the end of this report. More importantly, this brief overview barely scratches the surface of being able to understand the concept of the Metaverse. https://www.matthewball.vc/all/themetaverse

The analogy Matt uses to explain the Metaverse is extremely helpful as a starting point:

“If you want a simpler way to think about the Metaverse, you can imagine it as the Nightmare Before Christmas – you can walk into any experience or activity, and potentially address almost any of your needs, from a single starting point or world that’s also populated by everyone else you know. But what’s important is to recognize the Metaverse isn’t a game, a piece of hardware, or an online experience. This is like saying is ‘World of Warcraft’, Google or the iPhone, the Internet. They are digital worlds services, websites, devices, etc. The Internet is a wide set of protocols, technology, tubes and languages, plus access devices and content and communication experiences atop them. Metaverse will be too.”

What is the Metaverse?

The metaverse is an evolved version of the Internet, which brings together many technological advancements into a far more interoperable version of the world. In its end state, the Metaverse will be 1) the gateway to most digital experiences, 2) a key component of all physical ones, and 3) the next great labor platform. It is likely to produce trillions in value as a new computing platform or content medium.

Similar to how there is no “owner” of the Internet, there will be no owner of the Metaverse. However, the value of being a key participant, or even foundational piece, of this system can be clearly seen when juxtaposed to the companies who dominate the Internet. While nearly all leading Internet companies are among the most valuable companies in the world, so too will be the companies that lead in the Metaverse.

Since the Metaverse will be more expansive, consume more of a user’s time, and generate more commercial activity, it is highly likely that the Metaverse provides more economic upside than the Internet if it proves to be a successor.

New companies, products, services, and markets will emerge to “manage everything from payment processing to identity verification, hiring, ad delivery, content creation, security, and so forth. This, in turn, will mean many present-day incumbents are likely to fall.”

The Metaverse will transform the economic landscape; specifically, how we allocate and monetize scarce resources. The ability to participate in this future economy through virtual labor will be available to anyone, anywhere. The development of more resources coupled with availability of labor will make for a robust ecosystem.

The following two sections (by Matt Ball) will round out this section on the Metaverse (emphasis by SCM). Compare these points to the concept of finite and infinite games at the end of this section:

Characteristics of the Metaverse:

Be Persistent: Which is to say, it never “resets” or “pauses” or “ends”, it just continues indefinitely.

Be Synchronous and Live: Even though pre-scheduled and self-contained events will happen, just as they do in “real life”, the Metaverse will be a living experience that exists consistently for everyone and in real time.

Have No Real Cap to Concurrent Participations with an Individual Sense of “Presence”: Everyone can be a part of the Metaverse and participate in a specific event/place/activity together, at the same time and with individual agency.

Be a Fully Functioning Economy: Individuals and businesses will be able to create, own, invest, sell, and be rewarded for an incredibly wide range of “work” that produces “value” that is recognized by others.

Be an Experience that Spans: Both the digital and physical worlds, private and public networks/experiences, and open and closed platforms.

Offer Unprecedented Interoperability: Of data, digital items/assets, content, and so on across each of these experiences. Today, the digital world basically acts as though it were a mall where though every store used its own currency, required proprietary ID cards, had proprietary units of measurement for things like shoes or calories, and different dress codes, etc.

Be populated by “content” and “experiences” created and operated by an incredibly wide range of contributors, some of whom are independent individuals, while others might be informally organized groups or commercially-focused enterprises

What the Metaverse is Not

A “virtual world”: Virtual worlds and games with AI driven characters have existed for decades, as have those populated with “real” humans in real time. This isn’t a “meta” (Greek for “beyond”) universe, just a synthetic and fictional one designed for a single purpose (a game).

A “virtual space”: Digital content experiences like Second Life are often seen as “proto-Metaverses” because they (A) lack game-like goals or skill systems; (B) are virtual hangouts that persist; (C) offer nearly synchronous content updates; and (D) have real humans represented by digital avatars. However, these are not sufficient attributes for the Metaverse.

“Virtual reality”: VR is a way to experience a virtual world or space. Sense of presence in a digital world doesn’t make a Metaverse. It is like saying you have a thriving city because you can see and walk around it.

A “digital and virtual economy”: These, too, already exist. Individual games such as World of Warcraft have long had functioning economies where real people trade virtual goods for real money, or perform virtual tasks in exchange for real money. We are already transacting at scale for purely digital items for purely digital activities via purely digital marketplaces.

A “game”: Fortnite has many elements of the Metaverse. It (A) mashes up IP; (B) has a consistent identity that spans multiple closed platforms; (C) is a gateway to a myriad of experiences, some of which are purely social; (D) compensates creators for creating content, etc. However, as is the case with Ready Player One, it remains too narrow in what it does, how far it extends, and what “work” can occur (at least for now). While the Metaverse may have some game-like goals, include games, and involve gamification, it is not itself a game, nor is it oriented around specific objectives.

A “virtual theme park or Disneyland”: Not only will the “attractions” be infinite, they will be not be centrally “designed” or programmed like Disneyland, nor will they all be about fun or entertainment. In addition, the distribution of engagement will have a very long tail.

A “new app store”: No one needs another way to open apps, nor would doing so “in VR” (as an example) unlock/enable the sorts of value supposed by a successor Internet. The Metaverse is substantively different from today’s Internet/mobile models, architecture, and priorities.

A “new UGC platform”: The Metaverse is not just another YouTube or Facebook-like platform in which countless individuals can “create”, “share”, and “monetize” content, and where the most popular content represents only the tiniest share of overall consumption. The Metaverse will be a place in which proper empires are invested in and built, and where these richly capitalized businesses can fully own a customer, control APIs/data, unit economics, etc. In addition, it’s likely that, as with the web, a dozen or so platforms hold significant shares of user time, experiences, content, etc.

Matt’s description of what the Metaverse is, and is not, provides an ideal foundation for understanding the evolution of this future environment.

SCM has always been fascinated with game theory; we believe the notion of finite vs. infinite games should clearly explain why the Metaverse is not simply a “game” in the traditional sense. Without trying to get too abstract, there are at least two kinds of games: finite and infinite.

Finite games can be defined as having 1) known players, 2) fixed rules, and 3) an agreed upon objective (e.g. football). It has a definitive end and a clear winner.

Infinite games can be defined as having 1) known and unknown players, 2) interchangeable rules, 3) the objective is to perpetuate the game. Infinite games transcend time, and anyone can play.

A finite game is played for the purpose of winning, an infinite game for the purpose of continuing the play. For the infinite player, ceaseless change is not a discontinuing, change is the continuity. Only that which can change can continue.

A finite game is over when there is an agreed upon winner (between the players). There are no winners or losers in infinite games.

Only one person or team can win a finite game, but the non-winners could be ranked at the end (e.g. not everyone can be a CEO, but there are other positions.)

If you must play a game, you cannot play a game.

Spatial boundaries are necessary for every finite game, but infinite games have no boundaries. Finite players play within boundaries, infinite players play with boundaries.

Finite games cannot be played alone, one must have an opponent to play against, and usually there are teammates to play with.

Finite games can be played within an infinite game, but an infinite game cannot be played within a finite game.

In a finite game, the rules are fixed until there is a winner, but in an infinite game, the rules must change during the course of play. The rules of an infinite game are changed to prevent anyone from winning the game, and to bring as many other persons as possible into play.

Finite play occurs within a time frame, time is a diminishing quantity. For the finite player, freedom is a function of time, meaning they must have time to be free. The infinite player does not consume time, but generates it. Because infinite play is dramatic and unscripted, its time is time lived and not time viewed.

The Metaverse will be an infinite game, within which many finite games can be played.

Competition

Unity’s main competition is with Unreal Engine (Epic Games). There are also a few up-and-coming players in the space.

Before comparing the two game engines, it’s important to understand the competitive advantage that both engines benefit from – switching costs. Developing proficiency in an engine takes many months, which would significantly delay game/application launch. While some teams do use different engines for different projects, most developers specialize in one. So, developers don’t usually change engines after it starts creating an application. The extensive effort and rebuilding required to move an existing project to a new engine makes for high customer retention (low churn).

Epic Games Overview

Epic has three main business verticals: 1) game development, 2) the Epic Games Store, and 3) the Unreal Engine. Epic’s core competency is developing its own games and the vast majority of its $4.2B revenue in 2019 came from game development (primarily Fortnite). The Epic Games Store is a consumer-facing marketplace for gamers to purchase and download games, in which Epic receives a 12% commission. Unity and Epic don’t compete in these two businesses. To be clear, the public dispute between Epic and Apple over app store take rates does not affect Unity. Unity doesn’t have any of its own apps in the App Store and doesn’t have a consumer-facing store for games. It also shouldn’t provide much of a tailwind for Unity when it comes to existing games, since it’s already the primary game engine for developers building a game for iOS or Android. It remains to be seen whether or not this has an impact on future customer growth.

Background

Unreal: Started as Epic’s proprietary engine for their game “Unreal.” It became its own business line by being licensed to other PC and console studios.

Unity: Discussed above, Unity originally launched as an engine for indie devs building Mac games. Unity’s growth was fueled by its dominance in mobile game creation. Unity grew by catering to segments of the market that were largely ignored by the gaming industry, including AR & VR games, small studios, and mobile developers.

Market Segments

Unreal: Commands the majority market share among PC and console game developers since it is built for bigger and high-performance projects. However, Epic has shown its cross-platform capabilities with Fortnite’s mobile success. Unreal is also making some headway in AR & VR.

Unity: Unity is the leading player in AR & VR with +60% market share. It also dominates the mobile gaming landscape with +50% market share, which is the fastest growing segment within the gaming industry. There seems to be a clear bifurcation between use cases for these engines, as Unreal is not a common mobile alternative.

User Experience

There is not a big difference between Unity and Unreal when it comes to ease of use. Both can be pretty easily used by people who have basic coding skills and take time to test out the platform.

Unreal: Requires more lines of code and technical skill than Unity.

Applications are entirely customizable since it is an open source platform.

Blueprint is Unreal’s visual scripting tool. It is not a no-code solution to developing complex and high-performance games but makes the platform even easier to use.

Unity: Its focus has been on ease of use since inception (remember its mission of democratizing game development). Further removing frictions in the development process remains a key focus of the company.

The simplified nature of the platform makes Unity the preferred option for individuals and small teams creating casual mobile games, as well as for students learning to create.

Unlike Unreal, Unity only lets you edit the engine’s source code with an enterprise subscription. While this limits potential mistakes, it also hinders customization.

However, Unity recently released its own free visual scripting solution (Bolt).

Programming Language

Unreal: Utilizes the C++ programming language, which requires developers to do more programming but provides for more customization. This combination results in higher performance.

Unity: Utilizes the C# programming language which, is easier to learn and makes coding faster compared to C++. However, this language is not highly customizable. The difference in programming language fits the market segments these two engines dominate.

However, Unity has developed its “data oriented technology stack” (“DOTS”) which seems to be able to close this gap between ease of use and customizability (i.e. performance).

Pricing

Unreal: Revenue-share model, in which Unreal takes 5% of a game’s revenue. Epic forgoes this 5% take if the game is sold through its storefront.

Unity: Freemium subscription model with a portfolio of ancillary product offerings.

Both have separately negotiated pricing for companies outside of gaming.

Other Competitors

Proprietary Engines: Many large gaming companies continue to use their own proprietary game engines built in-house. However, a large and increasing number of companies are switching to Unreal or Unity given the ongoing investment / cash burn required to maintain the engine.

Outsourcing to one of the two main engines enables these companies to focus its resources on content creation and quality.

Amateur Engines - Are useful for people with limited or no programming skills to build simple 2D games. One such example is GameMaker Studio by YoYo Games. The latest was released in 2017 and is based on an easy-to-use single development workflow.

UGC Platforms: User-generated content platforms for creating and playing games, like Roblox, don’t compete with Unity right now because they are closed ecosystems with limited monetization opportunities due to its overly simplified nature. While it could attract some users in Unity’s free tier, no paying subscribers will make that transition.

Other Engines - Other competitive engines include:

CryEngine: Built by Crytek and popular for first-person shooters games

Lumberyard: Amazon’s engine built off CryEngine, which is known to be a failure in the gaming community. It has failed to garner widespread adoption in the developer community.

Cocos2D: Developed by Chukong Technologies, is an open source model that is popular with mobile game developers in China, Japan, and South Korea.

Financial Overview

Revenue

Total Revenue

Q2 2020: $184.3MM vs. $129.4MM (+42.4%)

2019 Annual: $541.8MM vs. $380.8MM (+42.3%)

By Segment (1H 2020)

Operate Solutions: $216.9MM (62%) - “substantial majority” from ads business.

Less than 10% of overall revenue is from “newer products and services, such as Vivox and deltaDNA”.

Since monetization (advertising) revenue comprises a “substantial majority” of Operate Solutions revenue, at least 31% of total revenue is related to advertising.

Create Solutions: $101.8MM (29%) - Unity Pro subscriptions were 65.5% of total.

Less than 10% of revenue comes from other Create Solutions like Unity Plus and Unity Enterprise subscriptions, as well as the engine ancillary tools.

Strategic Partnerships and Other: $32.7MM (9%)

Gross Profit

Total Gross Profit

FY 2019: $423.2MM (78% margin) vs. FY 2018: $299.5MM (79% margin)

Q2 2020: $143.9MM (78.1%) vs. $100.3MM (77.5%)

Free Cash Flow

Fiscal Year 2019 vs. 2018: -$95.0MM (-17.5%) vs. -$119.1MM (-31.3%)

2H 2020 vs. 2H 2019: -$34.7MM (-9.6%) vs. -$29.6MM (-11.6%)

Key Takeaways

Unity is not a pure SaaS company, only 29% of its revenue is subscription-based. The company underplays its role as an advertising (adtech) business (30%-50% of revenue), most likely to demand a higher multiple on its valuation.

Modest revenue figures given its position as the world’s leading game engine (53% of the top 1,000 grossing games in a $80B mobile gaming market), leaving SCM to question its monetization strategy.

Focus on enterprise customers: 74% of revenue is attributed to 716 companies paying Unity over $100,000 annually. While it seems that this strategy is in direct competition with Unreal, Unity may be intentionally focusing on this cohort to grow the number of highly skilled developers that know how to use the engine, as it tries to win business outside of gaming.

Given its 47% R&D Expense margin and slow uptake of industries outside of gaming, Unity’s operating losses will most likely persist until Unity increases its market penetration and scales its services (engine extensions) portfolio.

Risks

Slow Adoption Outside of Gaming: This is the main risk to the investment thesis. As of June 30, 2020, only 60 (8%) of Unity’s 716 enterprise customers were from industries outside of Gaming. While most of the top 10 architecture, engineering design, and automotive companies by 2019 revenues use Unity, they only reported 750 total customers from non-Gaming industries (vs. +100K in gaming).

This lack of penetration brings into question the $17B TAM Unity referenced for industries other than gaming in its S-1.

This is critical to watch, since Unity’s growth is reliant on penetrating and expanding within other industries and segments of the gaming technology stack. Unity has not been able to execute on this strategy yet, but it will need to if it is to be a successful investment.

Dominant Advertising Revenue Stream: While the mobile advertising is massive and growing rapidly, adtech companies trade at lower multiples due to the competitive landscape and commoditized nature of the product. As noted above, Unity is one of the largest mobile ad networks in the world. However, they are still far behind Google and Facebook in terms of market share.

Mobile Gaming Concentration: Given that the mobile gaming market is dominated by top gaming companies that are focused on building on their existing games, Unity’s engine growth is limited since it charges customers on a per-seat basis.

Monetization Struggles: SCM has identified a few different issues relating to Unity’s ability to monetize its platform. Its decision to not yet monetize IAP is not included here, as it is much more of an opportunity.

Live Ops: Unity’s cloud-based solutions still only contribute 9% to the total revenue base (at most 20%). Most of this revenue was acquired and there are many startups that create competition in the space. Additionally, there are not many differentiating factors amongst these applications (i.e. game hosting, matchmaking, player communications, etc.), so trying to press on pricing may hurt its main engine business. Additionally, the bigger these cloud services get, the more likely Unity will compete with the major public cloud providers.

Gaming: 74% of Unity’s revenue comes from just 716 customers and ~67% of its Create Solutions revenue comes from one subscription tier (Unity Pro).

Fragmentation: This could also be viewed as diversification, but it may be a concern that there is not one main product line that makes it clear as to what Unity is as a company. Is it a game engine? Is it an advertising platform?

Unreal Engine: While SCM believes there is room for both Unreal and Unity in the market, and Unreal’s growth outside of gaming actually benefits Unity, an argument could also be made to the detriment of Unity.

Given the slow adoption of industries outside of gaming, there may not be room for both Unreal and Unity to grow in the near term within these industries.

The gaming industry seems to be shifting towards mainly interoperable (across platform) MMOs where users can build social lives and participate in many different social events, such as live concerts (i.e. Fortnite’s Travis Scott concert). Unreal is built for this functionality, which would give them a massive leg up in the next evolution of gaming.

Advertising Headwinds: While SCM believes that Apples IDFA changes that are being effectuated in Q1 2021 will affect Unity less than other ad networks, it still poses a major risk:

The IDFA change mentioned above means that Apple’s SKAdNetwork will be the only way companies can receive users behavioral data outside the app. Additionally, the data will be much more limited compared to IDFA. This will make it difficult to target in-game ads and to measure the effectiveness of in-game ads at converting new customers.

Without this unique identifier, Facebook expects more than a 50% drop in revenue for its app developers. Since Unity has a revenue share agreement with publishers who use its ad network, the decline in revenue for these publishers would filter through to Unity.

Conclusion

Unity has the potential to become one of the most important and dominant technology companies in the world. While it is already has a dominant position within the mobile gaming market, its growth into industries beyond gaming will serve as an intermediate term catalyst for high value creation. Specifically, its engine will be the predominant source of AR & VR (MR) application development, which has the potential to be the next major computing platform after mobile. Its dominance in mobile gaming, as well as expertise in MR application development, will position Unity as a foundational “founder” of the Metaverse (as stated by Unreal). While it faces some near term headwinds in its ad business (Apple’s IDFA changes), and growth prospects in industries outside of gaming are largely unproven, an optimistic view of technology development would lead one to realize the importance of Unity moving forward. While the company may continue to burn cash through R&D in the short-term (although FCF margin is improving), these upfront investments will pay off in the long run as the leading provider of interactive, real-time, 3D content.

Fantastic analysis, Christopher! So much great information to process here. I work as a sound designer, so I have always been impressed in working with Unity for spatialization techniques and virtual modeling of physical/acoustic spaces. Amazing to learn about so many other possibilities with this software, especially in the Metaverse space! I am just starting to learn about that and WOW. Did I understand you correctly in the conclusion that Unreal says that Unity will be one of the main founders of the metaverse? Thanks so much <3

This is absolutely fantastic. Thank you so much.