Stock Market Update and the Path Forward

Hi Everyone,

I hope you all had a better and less volatile past week than the markets. I wanted to start with some quick housekeeping.

I was fortunate (in hindsight) to have a boss that challenged me every second, of every day, while I worked in private equity. What started off as a tumultuous relationship blossomed into a professional and personal relationship that I am immensely grateful for. I would not have the skill set and knowledge I have today without him. Everything he taught me revolved around three things: 1) Communication, 2) Organization, 3) Process (“COP”).

I want to focus on #1 right now. I try to be completely transparent in everything I do, especially with all of you who have kindly showed your support over the past few months. Last week I decided to charge for my detailed reports as a result of the time that goes into them and the quality of output. While the feedback has been extremely positive, it is apparent that this decision had a negative impact on my mission: To provide the best investment analysis available to the general public. To teach you not what to think, but rather how to think. As such, I will go back to the drawing board to figure out a solution that is optimal for everyone.

I have been back in Boston (Go Pats, Go Sawx, Go Bs, Go Cs) helping my mom move out of our childhood home. As such, I have not had the time to put together a company analysis. So, this week I want to provide you with an update on the markets. We will get back to the usual detailed analysis this Friday. I hope you all enjoy this issue of the newsletter. *Update: The internet was turned off before it should have been, so I wasn’t able to finish the newsletter until I got back in NYC.

Please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Let’s dive in!

Market Overview and Commentary

Year-to-Date (“YTD”) Market Performance

Nasdaq Composite (+18.94% YTD)

Normalized Index Performance (*Note the significant outperformance of the Nasdaq)

YTD Commentary: SCM will focus on the Nasdaq since it is the appropriate benchmark for “growth” investors, however the high level trends are consistent across the indices.

The Nasdaq started the year hot - advancing to 9,838.37 (+9.41%) through February 19th. Coronavirus news then led to a sell-off across the broader markets over the next five weeks, as the Nasdaq bottomed out at 6,631.42 on March 23rd. This was a 32.6% and 23.54% decline from its February high and YTD, respectively.

The index subsequently advanced at a rapid pace over the next five months, reaching a high of 12,074.07 on September 2nd. This represented an 82.1% increase off the March lows and YTD performance stood at 34.44%. Yes, this is all against the backdrop of a pandemic.

The indices have since retraced off its September 2nd highs, as the Nasdaq closed at 10,672.27 yesterday, September 24th. While this is 11.6% off its all-time high (“ATH”), the index is still up 18.94% on the year.

Note: While I don’t like to point fingers, it should be noted that my sister’s birthday is on September 2nd. I’m not saying the recent sell-off is her fault, but it’s quite a suspicious coincidence if you ask me!

U.S. Sector Performance

The Leader: It won’t be a surprise to those who follow the markets that the Technology sector (“XLK”) has carried the markets higher. After falling to a 22.8% YTD decline as of March 23rd, the sector rallied to its September 2nd high resulting in a +39.68% increase on the year. Quite the turnaround. The sector currently has advanced by 23.72% on the year as of trading today on September 25th.

Consumer Discretionary (“XLY”) and Communications (“XLC”) round out the top three performing sectors, which YTD advances of +14.47% and 8.60%, respectively. This is still a drastic underperformance relative to Technology.

The Laggard: Energy (“XLE”) continues to perform, for lack of a better term, miserably. The sector was down 60% on March 18th before making up significant ground by June 8th, when the YTD stood at “just” 20.21%. However, the sector has drifted lower over the recent months and now sits at -47.59% YTD.

A quick note on Energy. For those of you that missed it, front-month WTI oil contracts traded negative for the first time in history on April 20th. Prices fell to negative $38.45/barrel, or -310.45% on the day! While I won’t go into the mechanics here, you may enjoy this post from Institutional Investor.

Year-to-Date Performance Overview and Takeaways

If you’re confused as to how the markets could be up on the year given the global economic slowdown resulting from COVID-19, you’re not alone. So let SCM posit some ideas as to why this is the case, focusing on domestic markets:

Liquidity: Let’s take a step back to the 2007-08 Global Financial Crisis (“GFC”). Credit markets froze up and liquidity ground to a halt, putting the entire financial system at risk of collapsing. So, the Federal Reserve stepped in. From August 2007 to the early part of 2015, the Fed grew the Asset side of its Balance Sheet from $870 billion to $4.5 trillion. That’s 5.2x, or a ~24.5% compound annual growth rate (“CAGR”). For simplicity, think about every $1 increase to Fed Assets yielding a $1 increase to liquidity in financial markets. I’ll save a debate on the merits and consequences of this action for a separate newsletter. The Nasdaq bottomed at 1265.52 in early March 2009, then proceeded to rally to 4,900 by the end of Q1 2015 (3.9x). Fast forward to early March 2020, and the Fed’s Balance Sheet had only declined to $4.2 trillion despite strong economic performance. While it took the Fed 7.5 years to increase market liquidity by $3.63 trillion, the Fed increased its Balance Sheet by nearly $3 trillion in just 15 weeks! The Fed’s Balance Sheet increased from $4.16 trillion on February 24, 2020 to $7.2 trillion on June 8, 2020. It doesn’t matter that the rising markets were a result of Fed liquidity, what matters is that Fed liquidity caused markets to rise. “You play the hand you’re dealt, not the hand you want.”

There is No Alternative (“TINA”): While this slogan is widely attributed to Margaret Thatcher in regards to a free-market economy, the phrase has become popular in the finance community for a different reason. Investors seek to maximize their return (yield) for a given level of risk. So, if one asset class offers an unattractive yield to investors, funds will flow to the more attractive asset class. Let’s focus on the two most popular asset classes among retail investors: bonds and equities. Here is a snapshot of YTD performance of 10-year bonds from four major economies: United States, Germany, Japan, and Great Britain.

The large decline in YTD 10-year bond yields is even more pronounced in Japan and Germany, which now trade at negative nominal yields. The U.S. 10-year note is trading at 0.654%, meaning investors only receive a 0.654% annual nominal return on their 10-year investment. As a result, investors are receiving a negative real return with inflation around 1.3%. That doesn’t sound too attractive to SCM, how about you?

Rather than losing purchasing power (negative real return) by investing in bonds, investors are looking to the equity markets for yield. An appropriate comparison would be benchmarking the U.S. 10-Year against total shareholder yield for a broader index. The most reliable information found for total shareholder return is for the S&P 500, as shown below (source: Yardeni).

We can then calculate the total shareholder yield by dividing the trailing twelve month sum of buybacks and dividends by the current S&P 500 index price, as calculated by Yardeni. The current yield indicates equity investors can earn 4.44% return by investing in the broader equity market. Investors can earn nearly 3.8% more per year by investing in equities than bonds; compound that over ten years and that is a material difference. Investor preference for equities is a driving factor behind the equity markets performance.

Discount Rates (Valuation): SCM will keep this final takeaway brief. The value of an asset is the present value of its discounted cash flows. It follows that a company’s valuation should be based on the present value of its free cash flow (to be discussed another time), discounted at its weighted average cost of capital (i.e. the weighted average of the return required by equity and debt investors). The risk-free rate (U.S. treasury securities) is a core component of the cost of capital for equity investors. The 3-Month U.S. Treasury Bill is usually used as a proxy for the risk-free rate (as there is a de minimis risk of default). Its current value of 0.10% is ~140 basis points (“Bps”), or 1.4%, lower than in February of this year, when the T-Bill was trading at 1.52%.

SCM can elaborate on the potentially extreme impact of this change in a later newsletter. A simple example using perpetuities will suffice for now:

The present value of an annuity in perpetuity can be calculated as: Cash Flow / Discount Rate. So what is the difference in value of $1 invested at today’s discount rate (0.10%) vs. $1 invested in February at the discount rate at the time (1.52%)?

Current: $1 / 0.10% = $1,000; February: $1 / 1.52% = $67.79 - That’s a $932 difference in value of just one dollar.

This is an obviously simplified example, but you can interpolate this framework into the broader market and see the results.

The Path Forward

“Prediction is very difficult, especially if it's about the future!” -Niels Bohr

While it is helpful to understand why the markets have performed the way they have, let’s take a look at where we are today and what the future may hold.

Where We Are Today

Focusing once again on the Nasdaq, the market entered a “correction,” as defined by Investor’s Business Daily (“IBD”), on September 23rd. This is a result of the index recording a sixth distribution day in 25 trading days. SCM will save a thorough review of these concepts for a later newsletter, but have provided links for your review.

The Nasdaq had been trading below its 10-week simple moving average (“SMA”) and 21-day exponential moving average (“EMA”) for the past few weeks, a bearish sign for the index. The Nasdaq gapped up above these levels on Monday (bullish), however today marks the seventh day of a rally attempt for the index. The seven days is based on the September 21st intra-day low of 10,519.49.

What investors should look for in terms of a sign to add exposure to leading names is a follow-through day (“FTD”). A FTD is a day when the index has a strong price gain (>1.25%) along with higher volume than the prior session.

Key Takeaway: Building new positions here is risky since the majority of stocks tend to follow the overall market direction. Investors should be spending their time building watch lists of leading stock ideas, while avoiding adding exposure at this time. What kind of stocks specifically? You want to find stocks that are building bases (areas of consolidation) and show relative strength (outperformance vs. the broader markets). Specifically, look for stocks that were able to hold (stay above) their 50 day SMA, while the market undercut it.

Market Outlook

Let’s start with a long-term view: a monthly chart of the Nasdaq:

SCM’s view is that the market is in the middle of a secular bull market, which is of course subject to pullbacks like was just experienced. Investors should always prioritize capital preservation and protect against market downturns, however the overall market remains in a long-term uptrend With that being said, there remain the following headwinds and tailwinds in the market:

Headwinds

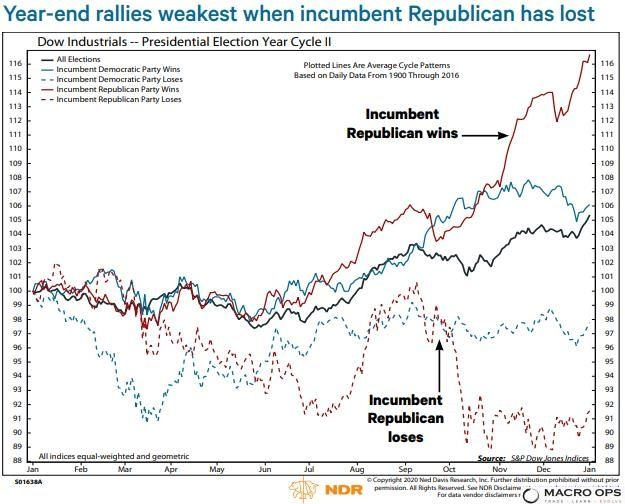

Political Risk: We will not get political in this newsletter, however Macro-Ops provided an interesting chart in their latest Monday Dirty Dozen [Chart Pack] as it relates to election risk. Additionally, a failure of congress to pass a bi-partisan bill to provide additional fiscal support in the wake of further economic destruction from COVID-19 would be problematic for markets.

COVID-19: A resurgence and subsequent lock-down would once again dampen economic growth.

Leaders Underperform: The entire market could get dragged down if the Technology sector, and specifically the leading stocks within the sector, start to underperform.

Fiscal and Monetary Policy (Longer Term): What will be the impact of actions taken by the Fed, resulting in massive growth of the monetary base? While it remains unclear, rapid inflation and / or stagflation would be detrimental to markets. How about increasing budget deficits as a percentage of GDP? The CBO just updated their long-term budget outlook and it is sobering to say the least. We will leave this graph here and let you peruse the additional forecasts at your leisure.

Q3 Earnings: Q3 earnings reports are forthcoming, which could be a headwind or tailwind for the markets

Tailwinds

Dry Powder: There remains an ample amount of cash sitting on the sidelines in money markets. Deployment of cash from money markets into equities can fuel the next leg higher (Source: BoA)

Psychological Factors: Markets are said to “climb a wall of worry.” This is consistent with the paradigmatic observation that market tops are associated with “irrational exuberance.” In essence, markets need bad news to churn higher. Contrarian sentiment indicators are helpful to gauge the level of sentiment in the market. One such measure is the Put/Call ratio, which measures the total number of puts / total number of calls. The current Put/Call ratio sits at 0.63 as of 09/29, well below the danger level of 1.15.

Zero Interest Rate Policy (“ZIRP”): The impact of low interest rates on asset valuations was discussed above. The Fed has stated its commitment to maintaining rates near the zero-bound for “years.” SCM will save the different impacts this could have on the economy for a later newsletter.

Innovation: The rapid pace of innovation and the digital transformation is still in the early innings. Companies are finding more use cases with these new technologies, leading to larger target addressable markets (“TAM”) and longer growth runways. Overall, this provides for a compelling picture of future returns.

SCM cannot predict the future. If we could, this newsletter would be written from our private island rather than this wonderful apartment in New York City. However, we can provide you with the facts to make your own judgements, as well as explain how certain dynamics affect markets. Additionally, providing the directional trend and high level framework for thinking about the markets patterns should prove useful in the long run. At the end of the day, the best we can do is understand the facts and make bets based on what we believe are the highest probability outcomes. Good luck out there!