Hi Everyone,

I hope you all had a nice week. In this edition of the Seifel Capital Newsletter, I am going to provide the first update on the SCM investment portfolio. You can access the full report in PDF form here. The purpose here is not to brag (if my returns are great) or be self-deprecating (if my returns are not good). Rather, I wish to share the thought process behind my decisions and the lessons I have learned by managing my own capital. I fundamentally believe that a focus on making the right / best decisions will yield superior long-run outcomes.

I highly recommend reading through the evolution of the decisions I’ve made and why they led me to develop certain rules. However, if you wish to simply get an overview of my investing rules, that I am still developing, you can jump to the end of this newsletter for an all-encompassing list. I hope some of these lessons and tips help you all in making better investment decisions, which is the entire purpose of this newsletter. This will be the first portfolio review of many, so I openly welcome any and all feedback. I hope you enjoy going on this investment journey with me.

Please note: This newsletter was written on 09/01/2020. Portfolio weights and returns have changed as a result of the past two days of trading volatility. I have added quick notes on important updates and changes where possible, however I have been traveling and unable to update the all-encompassing analysis. All changes will be captured in the next portfolio update.

* I significantly reduced my entire exposure to the market after 09/03/2020. The commentary below is focused on the lessons learned and my decision making process. The actual portfolio weights and positions have since changed.

Before we get started, please feel free to share this post, share my newsletter, or subscribe if you like the content.

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Now let’s dive into the SCM portfolio and individual holdings.

Portfolio Overview

This analysis was performed on 09/01/2020, at which time the portfolio was up 10.70% since inception. Although the analysis below is as of this date, I believe it is intellectually honest to mention that the portfolio is now at -1.31% after the recent sell-off through 09/03/2020.

The portfolio is underperforming both the Nasdaq (18.70% or -800 Bps differential) and the S&P 500 (13.75% or -305 Bps differential) over the measurement period. While there was one event that was the main contributor to the lagging performance, there were many more opportunities that would have resulted in improved performance had I adopted prudent portfolio and risk management tactics. I will elaborate on these opportunities throughout the newsletter. I am grateful for learning these lessons early in my career.

The SCM portfolio was tracking both the S&P 500 and Nasdaq (the “Benchmarks”) until August 7, 2020, when Alteryx Inc. ($AYX) and Datadog, Inc. ($DDOG) both fell dramatically after earnings, resulting in losses of 23.1% and 13.8%, respectively. The impact on the portfolio was a result of poor risk management, however it provided a valuable lesson which I will discuss later in this newsletter. The portfolio has slowly climbed out of the hole resulting from those two sell-offs, and the recent run-up in software names has further closed the gap with the Benchmarks.

At the time of this writing, I have common ownership positions in six businesses in the portfolio. However, I did previously have exposure to other companies, which I was forced to sell due to my loss rules (below). While this may seem like a very low figure to a lot of you, I believe it is a healthy allocation for SCM given two dynamics: 1) the amount of capital under management (“AUM”) and 2) my belief in concentration as the only means to truly generate alpha (more on this in future newsletters). CrowdStrike Holdings, Inc. ($CRWD) is the largest weight in the portfolio, as it is one of my highest conviction names in the public markets that have provided a buying opportunity.

Quick Notes:

Account inception was 07/01/2020, thus all return metrics are calculated from that date (Q3 2020 onward).

This is the first time I have truly actively managed a portfolio; there will be many lessons to learn! I do not want to give off the impression that I am a seasoned portfolio manager; this is a nascent skill set for me.

I run a concentrated portfolio, as I believe it is the only way to truly generate alpha.

I keep roughly 10% of my portfolio in cash to work on trading options.

We will now analyze the individual names and the role of each in the portfolio.

Individual Security Analysis – By Portfolio Weight

1. CrowdStrike Holdings, Inc. (NASDAQ: CRWD)

Investment Thesis: CrowdStrike will be the biggest beneficiary of the ongoing transition in the Cyber Security industry from a signature-based, on-premise (“on-prem”) solution to a behavior-based, cloud-enabled solution (“Security-as-a-Service” or “SECaaS”). The security challenges presented by the global digital transformation, in addition to today's remote or hybrid workforce, are best solved by a cloud-native platform. This company is the ideal example of an “asset-light compounder,” which provides critical services to all enterprises in the modern age.

Conviction Level: High – The detailed due diligence and research I have performed on the company has given me high conviction that the company has a immense upside potential.

Investment Takeaways: I have invested in CrowdStrike because of its extremely attractive fundamental outlook and the technical (price and volume patterns) picture provided proper entry points.

Pros

Correctly identified company as having significant upside; first purchase was made at $101.14.

Acknowledged the stock was breaking down and was able to exit trade at a profit (stock continued to fall 14% from average selling price).

Removed emotion from decision making process, sold to realize gains.

Cons

Made certain trading mistakes resulting in higher current cost basis.

Lesson Learned 1: Buy back into the stock, with more shares, when the stock gets back to the price at which you originally sold.

2. Fastly Inc. (NYSE: FSLY)

Investment Thesis: Fastly is the fastest growing company in an emerging high growth industry that is fundamentally changing the infrastructure of the internet. The combination of the best performance platform, industry leading visionaries and engineering talent, and efficient business model has the company set up to achieve a sustained competitive advantage for years to come. In a world of immediate gratification and data proliferation, companies need a reliable partner that can scale its business needs and deliver premier customer experiences. Fastly’s solution does just that.

Conviction Level: Medium-High – I have concluded that the company is a potential multi-bagger, even at these levels. Its recent acquisition of Signal Sciences bolsters my belief in its future outlook. However, the company has high execution risk and competes with the major cloud providers.

Investment Takeaways: I have invested in Fastly because of its massive growth potential. However, this is a volatile stock, which makes risk management even more important.

Pros

Initial investment was made at an attractive entry price of $79.65.

Cons

Did not wait for proper technical entry point.

Added to position at improper levels, that were not high reward / risk trades.

Lesson Learned 1: Improper planning led to a breakdown in strategy, which is why it is critical to properly pyramid into the trade. This resulted in a higher than necessary average cost basis.

Lesson Learned 2: Need to execute on offensive sell rules.

3. DocuSign Inc. (NASDAQ: DOCU)

Investment Thesis: DocuSign is the leading digital agreement and documentation company. Its solution has become increasingly more important in the post-Coronavirus world, in which business is being conducted digitally instead of in-person. The rapid digitization of the economy will exacerbate the need for individuals and businesses of all sizes to utilize the company’s services. DocuSign has a sticky solution with customers, who are unlikely to transition away from the company as its processes become integrated with the DocuSign platform.

Conviction Level: Low-Medium – I have not yet performed the in-depth research on DocuSign that is requisite for me to have high conviction in an investment. With that being said, the company has become an integral component of business processes and is the industry leader with a massive runway.

Investment Takeaways: DocuSign is the third largest weight in the portfolio because of its solid fundamentals and lack of a real competitive threat. However, the stock is extended as it has had a massive move from the $90s to its current level of $259.50. As such, it would be prudent to trim the position and realize some gains.

Pros

Identified great upside potential and invested at an entry price of $173.01

Although the stock had run up near 100%, I understood that stocks can often move multiples higher.

*Update: I trimmed my DocuSign position in half prior to its earnings release after hours on 09/03/2020.

Thought Process: It had a massive run-up prior to earnings and the entire software space was experiencing a broad and deep sell-off. I decided to lock in some gains and take some risk off the table.

Lesson Learned 1: Personal loss aversion - I would be more comfortable reducing my exposure and seeing the stock go up after hours, than leaving my position as-is and seeing the stock go down.

Cons

No notable changes that I would make to this trade; I invested in the company as soon as I started my portfolio and managed risk appropriately.

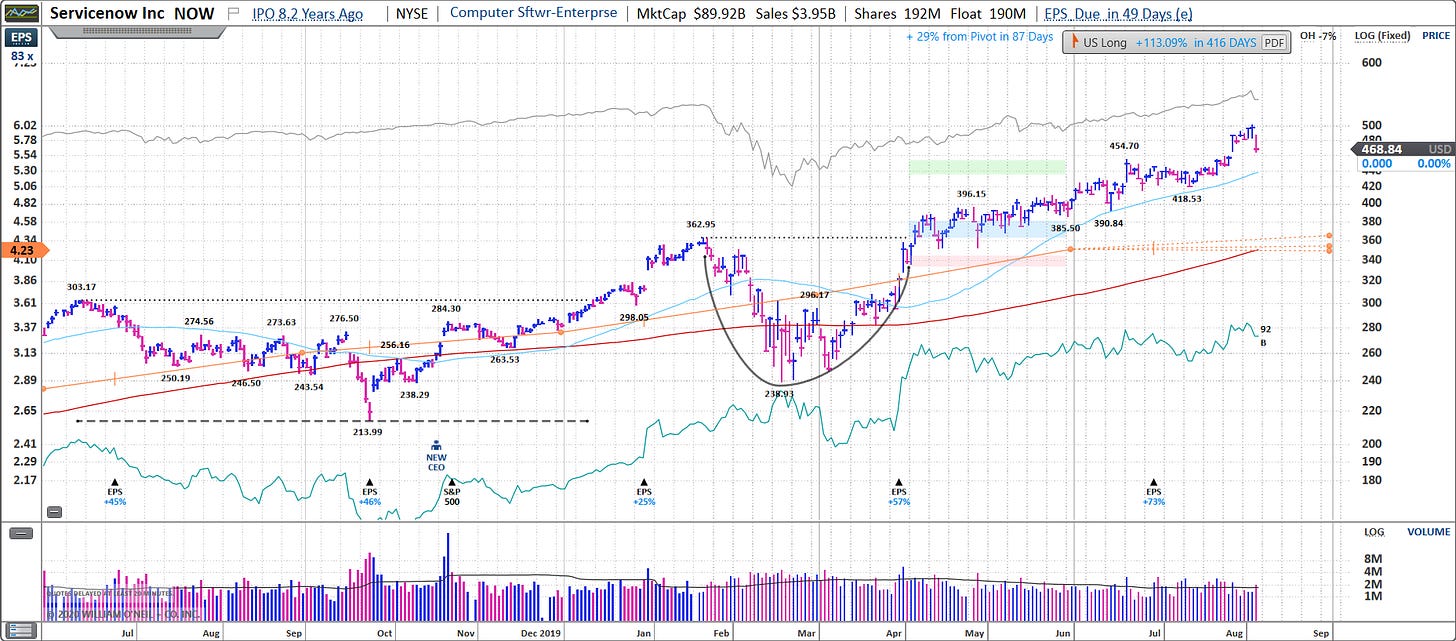

4. ServiceNow, Inc. (NYSE: NOW)

Investment Thesis: The world is experiencing a monumental shift from obsolete business processes to the new paradigm of digitized workflows, which has been accelerated by the Coronavirus. ServiceNow is a main beneficiary of this trend. The Now platform enables business continuity and resilience, which is critical for companies in the modern business environment. It is continuing to develop new products that are under-penetrated even with current customers, giving the company a long accretive runway. Additionally, its low/no code edge application allows customers to build and deploy bespoke applications within hours or a few days. These agile capabilities and quick time to value make the Now platform a critical product for organizations.

Conviction Level: Medium-High – I have not yet performed the in-depth research on ServiceNow either. However, even at a $4B revenue run rate, it is still growing at 32% top line and have actually increased staffing during the pandemic. Its product design and capabilities make the Now platform a leading business workflow and automation tool.

Investment Takeaways: ServiceNow has steadily appreciated in price since I purchased shares at $406.71. It has had a nice run-up since issuing Q2 earnings on July 29th and I anticipate holding the name long-term unless more attractive opportunities present.

Pros

Identified stable investment with upside potential in ServiceNow when first setting up the portfolio; attractive technical buy point.

Lesson Learned 1: Have the patience to stick with a company even as other stocks appreciated faster (but then subsequently declined).

Cons

No notable changes that I would make to this trade either, I’m happy with the execution here.

5. Zscaler Inc. (NASDAQ: ZS)

Investment Thesis: Gartner recently defined a new recommended path forward for overall enterprise networking & its security in one of its research papers. This paradigm is Secure Access Service Edge (“SASE”), which combines:

1. Software-defined networking (“SDN”): network a company, an IaaS, and end users together.

2. A complete cloud-based, identity-centric, Zero Trust solution to secure all endpoint traffic at the edge (Note: I promise to dive deeper into these concepts in future reports).

Zscaler has successfully carved out its niche in this new paradigm, as it has adopted a client-initiated Zero Trust Network Access (“ZTNA”). I am extremely bullish on Zscaler for similar reasons discussed above for CrowdStrike. Zscaler is laser-focused on being a cloud firewall and Secure Web Gateway (“SWG”) with a Zero Trust focus. They have 100+ data centers in their network, which all have customer traffic routed through them. This is a major differentiating factor between Zscaler and its competitors. In addition, its TAM continues to expand as use cases develop and cyber attacks continue to proliferate.

Conviction Level: Medium-High – I have not yet performed the in-depth research on the company, but I am extremely familiar with the business as a result of my research into CrowdStrike and the broader Cyber Security space. It has a leading and innovative solution to Cyber Security, and makes for a great partner with CrowdStrike. They handle over 60B transactions per day and will continue to be a core part of a company’s security plan.

Investment Takeaways: I had my eye on Zscaler for a long time and was able to purchase shares upon the development of an attractive technical set up. I am comfortable having both Zscaler and CrowdStrike in my portfolio (and would even add Okta if I find it prudent).

Pros

I patiently waited for a high risk/reward entry point instead of rushing in and buying the name at more elevated levels.

It is still a new holding, so I have yet to develop any positive takeaways from the investment.

Cons

I wouldn’t change anything as it relates to this investment.

6. Datadog, Inc. (NASDAQ: DDOG)

Investment Thesis: Datadog, Inc. (“Datadog” or “DDOG”) is the fastest growing company in a high growth industry, as it is more than doubling the growth of its two closest competitors, New Relic and Dynatrace. The combination of a leading monitoring and analytics platform with the newly released cybersecurity product makes for a holistic offering that adds immediate value to an organizations DevOps. The utilization of machine learning and a simple user interface makes the Datadog product attractive to market participants, as indicated by continued adoption and expansion within the current customer base. Founders Olivier Pomel (CEO) and Alexis Lê-Quôc (CTO) set out to provide full monitoring and analytics of an organization’s entire IT stack, and they are successfully executing on this vision. The market is not appreciating the sustainability of the company’s growth profile and ability to maintain industry leading margins. This company is an “asset-light compounder,” which can provide a critical service to all enterprises in the modern age.

Conviction Level: Medium-High – Datadog is eating its competition in a fast growing market, as observability is critical for every company in the digital age. Organization’s can’t risk poor application performance or down times, Datadog solves this problem by providing real time insights and preemptive action steps to solve problems before they arise. The company has a long runway and its land-and-expand model will enable high growth with margin expansion.

Investment Takeaways: Datadog’s growth and margin profile first caught my eye upon an initial screen so I took a starter position. I built immense conviction following my detailed investment research process and built a bigger position in the name. However, poor risk management significantly hurt this investment and my ability to realize gains.

Pros

I took a starter position instead of becoming fully invested before doing in-depth research.

Lesson Learned 1: If you identify an attractive opportunity, take a small starter position. This will encourage you to do your research, upon which you can build a more sizable position if your conviction warrants it.

Cons

I went into the company’s earnings report after making a modest profit on the original trade. However, the spread between my unrealized gain and loss limit was less than the implied volatility of the stock going into its report.

Lesson Learned 2: Never stay in a position going into a major catalyst event if the spread between your unrealized gain and loss limit is less than the max potential loss from the implied volatility.

Lesson Learned 3: Buy back into a position with more size if it gets back to your original selling price, only if you have strong conviction.

Lesson Learned: Alteryx, Inc. (NYSE: AYX)

I will not elaborate on the mistake made in my investment in Alteryx, since it is nearly an identical story to Datadog. However, I want to touch on one important point that is not often discussed.

Behavioral Response: Watching two of the (at the time) seven names in your portfolio fall greater than 20% after hours on the same day is gut wrenching to say the least. The psychological experience was profound, however I learned a lot about myself as an investor and developed the rule of thumb discussed under Datadog. I have the same cognitive biases as every other investor: confirmation, overconfidence, hindsight, extrapolation, etc. As you can tell, I am also loss averse; meaning that a loss feels worse to me than an equal gain. What’s important is to recognize you have these biases to try to counteract them accordingly.

I could have held on to both of my positions in AYX and DDOG after the sell-off, thinking I must have been right originally and they will certainly go back up. However, when the price and volume action says otherwise, indicating the market thinks otherwise, I will not let my ego hurt my overall returns. I was uncertain, so I did the right thing by getting out.

Conclusion

This was longer than previous newsletters, but I wanted to do my best to explain the thought process and rationale behind by investment decisions. I hope you all were able to glean some valuable investing insights from the lessons I’ve learned and experiences I’ve encountered these past two months. To wrap up the newsletter for this week, I would like to provide you all with a summary of the lessons I’ve learned and some of the other rules I have in place.

Investing Rules

Rule #1 - It does not matter how often you are right or how often you are wrong. What matters is the percentage gain you make when you are right vs. the percentage loss you incur when you are wrong. For you baseball fans out there, slugging % is more important than batting average %.

Rule #2 - When you are uncertain or have low conviction, either get out of the position or dramatically reduce your exposure.

As Bill O’Neil said: “The whole secret to winning in the stock market is to lose the least amount possible when you’re not right.”

Rule #3 - Maximum Loss Rule: 5% - this minimizes my left tail as I attempt to have positive skew in portfolio returns.

Rule #4 - Do Your Own Homework: Take a small starter position if you identify a potentially attractive investment opportunity. However, you must do your own research to truly understand the business and investment opportunity before building out a bigger position. You need to have conviction in your investments; conviction is developed by doing your own thorough research.

Rule #5 - Hold Your Winners, Sell Your Losers: Most investors sell their winners to “book profits” and then add to their losers, averaging down. You wouldn’t keep giving the worst performing employee a raise would you? The way to generate substantial returns over long time horizons is to ride your winners and sell your losers, in line with rule #4 above.

Rule #6 - Utilize Fundamental Analysis to Identify Which Stock to Buy, Utilize Technical Analysis to Determine When to Buy It: A business must pass my rigorous investment research process in order to make it on my buy list. However, I will not enter an investment until the technical picture provides a high reward/risk setup.

Rule #7 - Develop Your Own Rules, Investing Principles, and Investing Plan: Investing is HARD. As with any difficult task, identifying an objective, creating a plan, and executing on that plan is the pathway to success. Develop your own rules and processes and stick to it, otherwise you will get lost in your investing journey.

Rule #8 - Volume is Important: Volume up or down is indicative of supply and demand for a stock, it can indicate when institutions are entering or exiting a name. This is of high importance, as institutions drive the majority of price action.

Rule #9 - Never Stay in a Position if the Spread Between Your Unrealized Gains and Maximum Loss is Less Than the Implied Volatility from a Catalyst Event (e.g. Earnings Announcement): This was a critical lesson learned for SCM.

Rule #10 - You Play the Hand Your Dealt, Not the Hand You Want: Remove emotion from the picture and analyze the state of the market objectively. It doesn’t matter that you’re opposed to easy monetary policy inflating stock prices - it’s happening, so trade accordingly. Price action tells the story.

Rule #11 - Never Go Short in a Bull Market: I urge you all to read Reminiscences of a Stock Operator to truly understand this message.

I will continue to elaborate on these rules as I continue to learn and build out my portfolio management framework. I hope these were helpful for you all, but I urge you to develop your own rules.

Until next time,

Christopher

Thanks for sharing all the knowledge, Do you mind sharing the source of the DCF table you have in your SumZero datadog report?

Seifel, thanks for sharing your journey and your research reports. They are very helpful to understand the quality side of the business. I curious to know how you assets the valuations of the companies. I am not able to find a way to figure out if these companies with high revenue growth but with negative earnings are cheap, fair or overvalue, since I cannot use P/E, PEG discount FCF. Thanks in advance for your comments. Keep up with the good work