Hi Everyone,

In this week’s edition of the Seifel Capital Newsletter we will analyze Sea Limited (“SE”, “Sea”, or the “Company”). Similar to MercadoLibre, the research requisite for a full analysis of Sea was staggering. As such, I could not possibly fit in every piece of information about Sea in this newsletter, but I will hit on the core drivers of its performance and outlook. It truly is in the work that we are able to develop a fundamental understanding of these companies.

I recently spoke with a highly respected colleague about the work I’m doing. In preparation for my next role, I will be adding a new section to these newsletters which I think you will all enjoy. It will also make you think more deeply about the investment opportunity! As such, this newsletter will be published a little less frequently than a weekly basis. With that being said, I will endeavor to send out this newsletter at least every other week, if not sooner.

Please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

With that, please enjoy this report on Sea Limited!

Investment Overview

Executive Summary

Sea Limited (NYSE: SE) is the leading internet company in Greater Southeast Asia (“GSEA”). Sea has created a captive digital ecosystem through three distinct business verticals that create a virtuous feedback loop. Its Garena business unit is the region’s leading games and digital entertainment company. Its first self-developed mobile game, Free Fire, has been a massive success. The world’s top battle royale game recently surpassed $1B in global revenue and hit 100 million peak daily users in Q2 2020. Shopee is the Company’s e-Commerce business unit, which has grown into the largest and fastest growing digital commerce company in the region despite being only five years old. Finally, SeaMoney (formerly AirPay) is an e-wallet / digital financial services company that is integrated with Garena and Shopee (thus benefitting from its growth), but also offers standalone services.

While the Company has a first-class management team that is executing on its vision, industry tailwinds across the three major verticals provide for a long growth runway. The gaming market is continuing to grow at a rapid clip, aided by the rise of eSports. Garena’s focus on mobile gaming will prove highly beneficial, as it is expected to be the fastest growing segment in the space. As e-Commerce is under-penetrated (as a % of total retail sales) in the region, continued Internet and digital shopping adoption will be the catalyst for significant future growth as the regional economy catches up with developed markets. Digital financial services is critical for the region (similar to Latin America), as the majority of the region is unbanked or underbanked. Sea Limited is well-positioned to capitalize on the macro tailwinds fueling each of these industries due to its forward-thinking product offering and strategic decision making. As a result, the Company makes for an attractive investment opportunity given its long growth curve and leading market position.

Company Overview

Sea Limited is a leading global consumer internet company that was founded in Singapore in May 2009. Sea states that its “mission is to better the lives of consumers and small businesses with technology.” The Company accomplishes this mission through three core businesses across digital entertainment, e-Commerce, as well as digital payments and financial services. These three business lines are Garena, Shopee, and SeaMoney, respectively, each operating under the Sea Limited umbrella. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-Commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

Forrest Li is the co-founder, chairman, and group CEO. His journey started in 2005, when he heard Steve Jobs’ famous “You’ve Got to Find What You Love” commencement speech while attending his wife’s graduation from Stanford (Forrest is also a Stanford MBA graduate). Li was inspired and decided to pursue his passion for online gaming. He proceeded to launch a gaming company called GG Game in Singapore, which failed, before starting Garena in 2009 with David Chen and Gang Ye. Both Chen and Ye are still with the company, with Gang Ye serving as the Group’s Chief Operating Officer (“COO”) and David Chen serving as Shopee’s Chief Product Officer. Two events in 2010 powered the company forward. First it signed a deal to distribute games from U.S.-based Riot Games. Then Tencent, the China-based technology conglomerate, took a 40% stake in the company (currently ~25%), which gave Sea a big cash infusion. The Company then launched AirPay (now SeaMoney) in 2014 and Shopee in 2015.

While it started as a gaming platform, SE has transformed into an ecosystem poised to capitalize on a region with a population of 670 million people undergoing digital transformation (“DX”). The company primarily operates in the seven Southeast Asian markets (Singapore, Vietnam, Philippines, Malaysia, Indonesia, Taiwan, and Tailand) but has recently expanded into Latin America, as well. Macroeconomic tailwinds, strategic partnerships, visionary management, and operational execution serve as the foundation for the Company’s future success.

Key Business Drivers

Before discussing the Company’s business segments and operating results in more detail, it is important to understand the important factors that affect Sea’s operating results:

User Base: Revenue is predominantly driven by two key factors: 1) the number of users and 2) the level of user engagement. Broken down further by business vertical;

Garena - Digital Entertainment (“DE”): The “freemium” model dictates that the higher number of active users on the platform yields a larger number of users likely to make in-game purchases.

Shopee - e-Commerce (“EC”): Users of Shopee are both buyers and sellers; a greater number of buyers and sellers on the platform leads to a larger number and value of transactions (“Gross Merchandise Volume” or “GMV”). This subsequently drives higher advertising and commission revenues.

SeaMoney - Digital Financial Services (“DFS”): Revenue is generated by commission revenue, which is directly correlated to gross transaction value (“GTV”) or total payment volume (“TPV”). The larger number of paying users and merchants accepting SeaMoney are the two catalysts that drive higher TPV.

User Engagement and Monetization: User spending, and consequently revenue, are correlated to levels of user engagement across the ecosystem. While product quality and pricing is important for any company, monetization for Sea is a result of two levers: 1) its ability to convert active users into paying users (increasing the conversion rate) and 2) increasing revenue per paying user.

Garena: Primary source of revenue is the sale of in-game virtual items. High quality and localized, catered to preferences of specific markets, allows Garena to create a highly-engaged user experience. The users are more likely to make purchases of in-game items since it matches their tastes.

Shopee: Optimizing product assortment on the marketplace increases the number of transactions per active buyer, while building effective merchant tools to attract sellers. Monetization commenced in 2017 in Taiwan and Indonesia by offering cost-per-click (“CPC”) advertising to feature and promote seller products in search results generated by buyers. Think about this as a company paying for shelf space in a store. Additionally, commission fees are charged for completed purchases.

SeaMoney: Increasing the number of transactions through SeaMoney results in higher GTV, and thus higher commission income. The number of transactions is driven by expanding DFS use cases through SeaMoney, including the expansion of AirPay counters (i.e. a “reverse ATM”).

Business Segments

Garena: Garena was launched in 2009 and is the exclusive operator and distributor of leading mobile and PC online games including Free Fire, Call of Duty: Mobile, and Dauntless and in GSEA. The games are offered through two primary distribution channels: 1) a desktop or mobile Garena app, and 2) cybercafes. It enters into licensing contracts with game developers with a typical term of three to seven years and retention of 65% - 80% of gross billings. The balance of gross billings are paid to the game developer. As mentioned above, it’s primary revenue sources are the sale of in-game virtual items and season passes. Performance drivers were discussed above. There exists further monetization opportunities in the DE segment, including video advertising and premium pricing through subscription models. The important points to understand about this business segment are:

Internal Development Success: Garena’s first self-developed global hit game, Free Fire, was the most downloaded mobile game in 2019 and it has remained one of the world’s most popular games according to App Annie. Through Q2 2020, it is the third most downloaded game and has the fifth most monthly active users in the world. Additionally, it achieved a new record high of over 100MM peak daily active users, and was the highest grossing mobile game in Latin America and SEA in the same time period. What remains a huge opportunity for Garena is monetization, as despite the game’s popularity, it does not rank in the top ten of total consumer spend. Game development will continue to be a growth engine for the Company, as it is able to identify new game opportunities aligned with gamer tastes that it acquires through data collection and market research. Running the turnkey development process gives Sea full control of product quality and increases profitability, as the self-developed games are more margin accretive due to savings from royalties. Profitability can be seen in Garena’s EBITDA margin improvement from 37% in Q4 2017 to 61% in Q2 2020. To further these efforts, the Company acquired Phoenix Labs (US-based creator of Dauntless) in January 2020 for $150MM to further develop its in-house content creation capabilities.

eSports & Streaming: eSports is a fast growing phenomenon, as the market is expected to grow at a +24% CAGR for the next seven years. Mobile is starting to become a new pillar in the eSports community, as viewership increased from 15.3MM hours in 2018 to 98.5MM in 2019 (+544%). Livestreaming of online gameplay, social features such as user chat and online forums, and other features increase user engagement and creates a two-sided ecosystem between developers and gamers. As discussed above, higher engagement yields higher monetization and revenue. Garena’s success in this space can be seen in the results of Garena World 2019, which hosted the first Free Fire World Cup. Around 270,000 people attended the two-day event and it attracted more than 27MM online views. The Free Fire Pro League Brazil 2019 was also a success, reporting 13MM views on YouTube alone. Continued leadership in eSports and livestreaming will attract more users to the platform, increase user engagement, and thus drive monetization.

Virtuous Cycle: SCM thinks about the Garena model as self-reinforcing virtuous cycle. 1) Gamers download Garena games from a variety of app stores (Apple, Google Play, Garena App, etc.), which are highly tailored to their tastes, 2) More gamers join the platform due to the highly engaging content (which also drives monetization), 3) Developers join the platform as they know the popularity of their games will be expedited given their access to a large, growing, and highly engaged user base of gamers, 4) More games are added to the Garena ecosystem, increasing monetization opportunities, 5) More gamers join the platform to play the new games. Then repeat. This virtuous cycle paradigm can be seen in the DE User Growth graphic below, as Quarterly Active Users (“QAU”) and Quarterly Paying Users (“QPU”) have grown at a CAGR of 93% and 97%, respectively, since Q3 2017.

Shopee: Shopee was launched in all seven GSEA markets in June 2015 and has since become the market leader as measured by monthly active users (“MAU”) and website traffic (graphic below). This platform connects buyers and sellers through a highly customized and localized experience, which is supported by an integrated payment solution (SeaMoney) and seamless third-party logistics and fulfillment. It’s important to note that Shoppe holds no inventory risk, and thus is highly scalable. The platform is dominated by “long-tail” categories including fashion, healthy and beauty, baby products and toys, and home goods. The expansive product offering has resulted in a diverse seller base and higher order frequencies relative to other consumer products. Sea Limited’s management team designed its e-Commerce marketplace with the future in mind. Understanding the rapid growth of smartphone users in the region, Shopee was built around a mobile-first design, while embracing social features (i.e. liking and following), which further enhances user engagement. Shopee revenue is generated from 1) transaction-based fees (market-dependent), 2) value-added services, and 3) CPC advertising.

Value Proposition - Buyers: Shopee drives user engagement through innovative social and gaming features such as “Shopee Coins”, “Shopee" Live”, “Shopee Games”, and others. Users can utilize search and filter functionality to find specific products in mind, or use Shopee’s innovative personalized recommendation functionality to find new product. Both features create a more user-friendly experience and drive increased transaction volume. While many marketplaces completely bifurcate buyers from sellers, buyers on Shopee can utilize a live chat function to ask questions of sellers. Building trust between counterparties is important; the aforementioned chat function, “Shopee Guarantee”, and seller rating system all assist towards that end.

Value Proposition - Sellers: The predominant vendors on the marketplace have been individuals and SMEs, but that cohort began expanding into brands and large retailers when the company launched its “Shopee Mall” B2C initiative in 2017. As with other marketplaces, it is essentially a virtual storefront that allows sellers to process transactions, but also communicate with buyers. Shopee provides seller tools to help analyze their selling trends and optimize their product offering. “Shopee University” provides sellers with training on how to develop a highly functioning online store.

Rapid Success: Shopee has become the largest and fastest growing e-Commerce platform in the region in just five years, reflected by Gross GMV and Gross Orders growing at a 96% CAGR and 111% CAGR, respectively, since Q3 2017. In Indonesia, its largest market, Shopee has grown total orders and average daily orders by a 102% and 100% CAGR, respectively, since Q3 2018. When asked which factors contributed to their growth in the SEA Region, Agatha Soh, Head of Regional Marketing for Shopee in Southeast Asia said “a mobile-first approach [that] helps attract the online consumers who are bypassing desktops, and going straight from offline shopping to mobile shopping.”

SeaMoney: Sea’s digital financial services business was launched in 2014 and is currently very small relative to Garena and Shopee, however, it is also its largest opportunity. With +70% of the region’s population “unbanked” or “underbanked”, coupled with massive industry tailwinds and an organic customer acquisition engine (via integration with Garena and Shopee), SeaMoney has a long growth runway. The current model earns revenue from e-wallet transactions through commissions charged to third-party merchants (as a % of GMV), and interest charged to borrowers under its consumer credit business. While its core business consists of e-wallet services and payment processing, expansion into micro-lending and other related digital financial services has created additional revenue streams for the unit.

Value Proposition - Consumers: Consumers can process payments on Garena, Shopee, and other third-party merchants even if they don’t have a bank account. This is beneficial not only for consumers, but also for the regional economy as whole, as it breaks down commerce frictions embedded in a hard money system. The SeaMoney platform removes the need for credit cards (which isn’t popular in the region) or a bank account. Under its AirPay brand, consumers can “top-up” their accounts by depositing cash into physical AirPay counters (“reverse ATMs”). Integration with Shopee and Garena creates a virtuous ecosystem for Sea, as it currently processes a good portion of gross billings across some of its biggest markets (i.e. +40% of Shopee gross orders in in Indonesia in April 2020). Additionally, this integration is margin accretive for Sea, as it reduces payment channel costs. The cost structure will continue to come down, and captive ecosystem will continue to strengthen, as Sea processes a higher portion of GMV in its markets.

Value Proposition - Merchants: First and foremost, merchants have easier access to the business of customers that previously did not have a credit card or banking solution. A broader customer base, professional payment solution, and seamless collection of remittances makes the SeaMoney platform highly beneficial for merchants.

Growth Prospects and Regulatory Environment: SeaMoney currently holds the requisite licenses and government approvals to provide electronic money services in Vietnam, Thailand, Indonesia, the Philippines, and Malaysia. Additionally, it is able to operate its credit program in Indonesia and Thailand (following a partnership with Thailand’s Kasikornbank). A big tailwind will come following the anticipated approval by the Money Authority of Singapore (MAS) for a digital full bank license in the country. As of June 2020, SE is one of 14 applicants that have been approved to move forward in the process. If Sea is granted one of the five licenses being granted by MAS in Singapore, it will open up access to business with millennials and SMEs across the region. The awarded licenses will be announced in 2H 2020 (imminent), with operations able to commence in mid-2021.

Industry Overview

Market Opportunity

Overview

A little over a decade ago, four out of every five Southeast Asians had no Internet connectivity and limited access to the internet. In the present day, this population represents one of the most engaged mobile Internet cohorts in the world, with 360MM Internet users and 90% of whom are connected primarily through their mobile phones. GSEA is one of the largest and fastest growing regions in the world with a population of 670 million people and GDP expected to reach $4.7T by 2025. The GSEA Internet economy has more than tripled in size over the past four years, reaching $100B in 2019. The expected growth is staggering, as it is expected to reach $300B by 2025 (20% CAGR), led by e-Commerce and Ride Hailing.

Indonesia and Vietnam are the two leaders, as their Internet economies are growing more than 40% annually. Malaysia, Thailand, Singapore, and the Philippines all sport healthy annual growth rates between 20% - 30%. However, there is still a lot of room to grow. Seven metropolitan areas contain 15% of the region’s population, but account for more than 50% of the Internet economy. People in the metros buy six times more online than people outside of these areas, representing a large opportunity for companies who can access these rural areas.

Many of the new Internet users were aged between 15-19. The favorable regional demographics will play a huge role in continued growth, as ~150MM people will turn over 15 years old over the next 15 years (10MM new users per year).

Not only are more people spending time on the mobile Internet, but more people are also spending money on online services and products, as over 180MM people now participate in the Internet economy. The majority of active users participate in e-Commerce and online gaming activities.

Gaming & Digital Entertainment

Niko Partners reports that GSEA’s total gaming market revenue is expected to grow at a 13.2% CAGR from $5.1B in 2019 to $8.3B in 2023. The number of PC gamers is expected to grow from 154.3MM in 2019 to 186.3MM by 2023 (4.9% CAGR), while mobile gamers is expected to grow from 227MM to 290.2MM (6.3%) over the same period. Mobile gaming revenue will be the core driver, which is expected to grow at a 15.8% CAGR. PC gaming revenues will also grow at a healthy 9.4% CAGR during this time. The proliferation of smartphones and rollout of 5G are near term tailwinds, with growth coming in two ways: 1) Increased penetration of smartphone users play mobile games (currently 40%), and 2) Growth of smartphones in the region (expected to grow from 527MM to 679MM by 2023 - 8.8% CAGR).

App Annie reported that mobile apps and gaming surged to the highest levels ever during Q2 2020, with over 14B downloaded games. The spike in downloads seems to be persistent, as there were +1.2B mobile game downloads in the first week of Q2 (a record) and weekly downloads remained at 1B on average throughout the quarter. This 20% YoY increase was accompanied by a new quarterly record for consumer spend in mobile games, with $19B spent on purchases through the app stores in Q2 2020 (a 15% sequential increase). Additionally, monthly time spent in all mobile apps grew 40% YoY in Q2 2020, reaching an all time high with over 200B hours in April.

Esports is the main growth engine for the gaming industry in Asia. A staggering 95% of PC gamers and 90% of mobile gamers engage in eSports. The global Esports market is expected to grow from $1.1B in 2020 (+15.7% YoY from $950.6MM in 2019) to $6.82B in 2027, 24.4% CAGR. The $822.4MM (74.8%) of revenues will come from sponsorships and media rights, a 17.2% increase from last year.

The global eSports audience will reach 495MM people in 2020 (+11.7% YoY), comprised of 222.9MM “eSports Enthusiasts” and 272.2MM occasional viewers.

Average revenue per eSports Enthusiast is expected to reach $4.94 in 2020, a 2.8% YoY increase.

Mobile is the main growth driver, as games like PUBG mobile and Garena Free Fire have taken off. This has led to massive expected growth in SEA (+24.0% CAGR), Japan (+20.4%), and Latin America (+17.9%) from 2018-2023.

Gaming Competition

The SEA gaming industry is a highly fragmented market, but globally is dominated by major players such as Tencent, Sony, Microsoft, Apple, Activision Blizzard, Google, NetEase, EA, Nintendo, and more. A major positive development for Garena is the recent ban of a major competitive game, PUBG, in India. The benefits appeared immediately, as Free Fire was downloaded 2.1MM times in India in the four days after the ban while Call of Duty Mobile was downloaded 1.2MM over the four days.

e-Commerce

e-Commerce is now the biggest sector of the Internet economy after staggering growth the past four years, with GMV growing from $5.5B in 2015 to over $38B in 2019 (62.3% CAGR). The sector is expected to reach $153B by 2025 (26% CAGR), $50 billion more than predictions made over a year ago. Additionally, revenue generated by e-Commerce companies is anticipated to grow from $37.9B in 2019 to $88.1B in 2023 (18.4% CAGR). The important point to note is that e-Commerce is still vastly underpenetrated (as a % of total retail sales) in the region at 6.2%, relative to developed economies. Online shopping festivals are a major source of growth, including 9.9, Singles Day, 12.2, and more continue to pop up.

Entertainment has become an important promotional strategy, as live streaming videos of popular “influencers”, along with live auction processes, have made buying and selling more interactive. Many initiatives are combined with elements of “gamification” to further engage users, which generates valuable insights on consumer behavior and preferences. This helps e-Commerce companies optimize their marketplace offerings through Machine Learning. Finally, the shift in consumer behavior for online shopping from big-ticket items to a regular shopping experience has led a declining average order value (“AOV”). Moving forward, e-Commerce companies will have to prioritize monetization (i.e. charging for VAS, logistics, and inventory management), given the current high cost nature of logistics.

e-Commerce Competition

The SEA e-Commerce industry is highly competitive, but led by Shopee. The top three EC players in the region in order are Shopee, Lazada, and Tokopedia. Shopee faces competition on two fronts: 1) Platforms that operate across several markets (e.g. Lazada, AliExpress, eBay), 2) Single-market players in countries they operate in (e.g. Tokopedia, Bukalapak, Sendo). Additionally, Shopee competes internationally with regional leaders such as, Alibaba, Amazon, JD.com, Rakuten, and Mercadolibre.

Digital Financial Services

As previously discussed, Southeast Asians have insufficient access to many of the basic Financial Services available to developed economies take for granted. New technologies are capable of solving this challenge, but adoption and usage among the population are still limited. Approximately 400MM adults live in SEA, but only 104MM are fully “Banked” with full access to financial services. Another 98MM are “Underbanked” (have a bank account, but insufficient access to credit, investment and insurance), while 198MM remain “Unbanked” and do not own a bank account. Thus, 74% of the population needs a DFS solution.

SMBs also face many challenges, from a widely dispersed landscape to the highly regulated banking sector in many SEA countries (which, of course, stifles competition and innovation). The technology and data provided by DFS can help solve these issues by increasing access, improving convenience, improving cost structures, and creating a more inclusive economy. Credit cards can assist here, and the availability of credit cards is correlated to economic growth. 2019 credit cards per capita were 0.1 in SEA and 2.1 in the U.S., while penetration rates were 13.4% in SEA: 13.4% and 212.2% in the U.S.

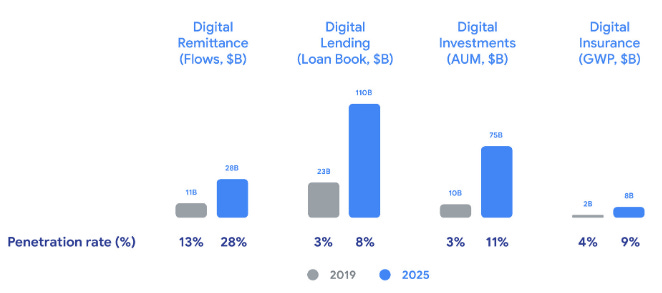

Specifically, five separate financial services will play a major role in this transformation:

In terms of growth, digital payments are expected to reach $1.1T by 2025, representing a 10.6% CAGR, and accounting for ~50% of total GTV in the region. E-wallets is a key driver here, as it is expected to grow over 5x from $22B in 2019 to $114B in 2025.

Finally, growth will be fueled by increasing penetration rates across the variety of financial services. While digital financial services are still nascent in the region, drastic improvements are expected over the next five years. Specifically, digital lending will be a primary growth driver due to innovations in both consumer and SMB lending.

DFS Competition

The DFS competition in GSEA is fragmented without any clear winners, with companies competing across four categories:

Pure-play Fintech: independent players that compete in a particular segment with a new business model or technology. These companies include Momo (Vietnamese payments), Stashaway (digital wealth management), and Akulaku (Indonesian digital lender). High CAC and unstable LTV make for a difficult business model in the region.

Consumer Technology Platforms: Regional Internet companies including Sea Ltd., Lazada, Gojek, and Grab. The benefit these companies have is an existing user base. They began payment services to help facilitate their core businesses, but have pivoted to expanding their digital financial services.

Established Financial Companies: Banks, insurers, and other financial institutions that are disadvantaged by legacy solutions and a stringent regulatory environment.

Established Consumer Companies: Retailers that have broad consumer reach through physical distribution networks but lack experience.

Investment Thesis

Flywheel Effects: Developer relationships lead to more games, which brings more users on to the platform, which brings more developers to the platform. Improved monetization benefits both developers and Garena. Similarly for Shopee, better tools and services for merchants brings more sellers to the platform, so buyers join to find products, who benefit from AI and engagement tools, who then buy more items, attracting more sellers.

Captive Ecosystem: Integrating SeaMoney with Garena and Shopee creates a better user experience, but also enables the company to grow its DFS unit. The growth of e-Wallet and other DFS will further enhance the company’s virtuous flywheel.

eSports: Garena has positioned itself as an eSports leader, which will benefit from rapid secular growth. Its focus on mobile was a strategic decision that will pay off.

e-Commerce Penetration and Digital Runway: e-Commerce penetration in SEA of 6.2% lags behind the 16.1% figure reported in the U.S. for Q2 2020. Additionally, through the lens of the Internet economy, SEA is nearly ten years behind the U.S. While SEA is projected to have its Internet economy reach 6.3% of the total in 2025, the U.S. was at 6.5% in 2016.

Shopee Monetization Opportunity: Shopee’s growth has led to higher take rates and lower shipping subsidies (thus higher profitability). However, the take rate still has a lot of room to run, as Shopee is currently still trying to scale the business and strengthen its network effects. However, with scale will come higher commissions, higher advertising fees, and more value-added services. Take rate improvement was seen in Q2 2020, increasing to 4.7% from 3.8% in Q1.

Market Dominance: The success of Free Fire is accompanied by a valuable partnership with Tencent, giving Sea a competitive advantage in the gaming market. Additionally, based on a GMV of $17.6B in 2019, the company has a 46.2% share of the total e-commerce market. That being after only five years of operations. The continued scale and market dominance will enable better profitability in oncoming years.

Food Delivery: Expansion into food delivery and groceries is another tailwind for SE, as it continues to ramp its Shopee Mart program and continue to promote ready-to-eat food on its platform.

Valuation

The appropriate methodology to value Sea Ltd. will be a sum-of-the-parts (“SOP”) analysis, by valuing each business unit separately. However, this may not fully capture the value of the virtuous flywheel that benefits Sea. The current enterprise value of Sea Ltd. is ~$81.5B.

Garena

Garena generated $1.3B of TTM Adjusted EBITDA on $2.2B of Revenue, yielding a 58.7% margin. The DE unit has grown Revenue at an 80% CAGR since Q4 2017, with TTM revenue in Q2 2020 clocking in at 78.1% YoY growth. However, growth has decelerated substantially in 2020 to 30.3% and 61.6% in Q1 and Q2, respectively. Taking these data points into account, SCM will assume 50% growth in TTM revenue over the next twelve months, or $3.2B. At a 58.7% margin, that yields $1.9B in EBITDA. Assuming an 8% cost of capital, or roughly 12.5x EBITDA multiple, would yield a valuation for Garena of $23.75B.

Note: Original FY 2020 Guidance was revenue of $1.95B, however the unit has already achieved $1.28B of revenue including $716MM in Q2.

Note 2: Garena’s public market comps are trading at an average EV / NTM EBITDA multiple of 16x.

Shopee

Shopee is not yet profitable, so a Revenue analysis will be the starting point. Revenue has grown at a 328% CAGR since Q4 2017 and 187.7% YoY growth rate in Q2 2020. Given the unprofitable nature and rapid revenue growth of this unit, traditional valuation methodologies orthogonal. The appropriate methodology will be valuing Shopee off GMV. Revenue still needs to be referenced as a reference point.

Since Shopee revenue has grown +170% on a TTM basis over the past two quarters, applying the same growth rate to the current TTM revenue of $1.44B would yield $3.89B of revenue over the next twelve months.

Alternatively, utilizing the run-rate take rate of 5.9% would yield $2.59B of revenue. SCM expects take rates to improve from this level to 7% over the next year (still trailing a lot of competitors), which would yield revenue of $3.1B.

Shopee has grown TTM GMV between 71% and 98% over the past five quarters, resulting in $24.4B of GMV in Q2 2020 (which was a 109% YoY increase).

As a midpoint, GMV can be estimated to grow by 80% over the next twelve months, reaching $43.92B in Q2 2021.

Alternatively, based on an e-Commerce market growth of 26% CAGR, the market is expected to reach $60.32B in 2021. However, this does not include Taiwan or other markets Shopee may grow its presence.

As such, SCM will maintain its estimate of $43.92B GMV.

The sector average GMV multiple is 1.8x, however Asian EC companies trade at a discount to this figure, evidenced by the 1.5x GMV Alibaba paid to acquire Lazada. SCM will apply a 30% discount to the peer group multiple of 1.8x, resulting in a 1.25x multiple for Shopee. This multiple estimate yields a Shopee valuation of $54.9B.

SeaMoney

Sea Ltd. does not disclose much information related to the financial performance of SeaMoney. Digital Financial Services peers trade between 0.2x - 0.6x TPV multiples. SCM will assign the midpoint multiple of 0.4x to SeaMoney’s run rate e-wallet TPV of $6.4B, resulting in a value of $2.56B. Given the flywheel effects that SeaMoney benefits from by being integrated with Garena and Shopee, this will most likely prove to be a highly conservative estimate.

Total Value: The base case valuation comes out to $81.2B, essentially right in line with Sea Ltd.’s current valuation. The stock seems fairly valued currently. Granted, if Garena traded in line with its peers at 16x EBITDA, that would add another $7B of value.

But at a current valuation of $81B, juxtaposed against macro trends and Sea’s competitive positioning, this stock can be a 10-bagger ($810B valuation) over the next 10-15 years.

Appendix

Great insightful article, well developed, outlined a solid case without hype

Excellent analysis. Thank you.