SCM Investment Research Process - Part I

Idea Generation, Company Research, and Understanding Business Models

Hi Everyone,

Happy New Year! To avoid confusion and technical mishaps moving forward, I will be sending out the newsletter through substack but will keep a copy of the post on my website. My sincere apologies to those of you who were not receiving newsletters being sent out from my website. You should be all caught up now.

I am motivated to keep the pace of a weekly newsletter this year (it is one of my 2021 goals). It will still contain company analysis (when ready) and thematic / industry research (when ready). I will sprinkle in a wide variety of investing topics, all aimed to help improve your process, knowledge, and abilities.

I have been receiving numerous requests to provide more insight into my actual investing process after my appearance on the 7Investing podcast last week. So, to start the year off right, my first two newsletters this year will cover the core aspects of the process I go through when analyzing companies. I am breaking it up into two separate newsletters in order to not crash your inbox (somewhat joking).

For clarity - this is a process and checklist I have developed through independent research and what I have gleaned from actual practitioners. It is a constantly evolving process that I seek to improve upon and make more efficient. Please comment or reach out if you have any comments or ways you feel I can improve my process! Two of the books that have been especially helpful are:

Best Practices for Equity Research Analysts by James Valentine (I literally mapped out everything he talked about in an excel spreadsheet…)

Pitch the Perfect Investment by Paul Sonkin and Paul Johnson

You can listen to their appearance on the Capital Allocators Podcast here

Please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

The Checklist

On Oct. 30, 1935, at Wright Airfield in Ohio, the Model 299 lifted off, climbed to 300 feet, then stalled and crashed killing two of the five crew members, including the pilot. An investigation determined that pilot error caused the crash. While tending to the airplane’s multitude of switches and controls, the pilot forgot to release a new locking mechanism on the airplane’s elevator controls. Critics declared that the Model 299 was “too complex to fly.”

Boeing initially lost the contract, but some remained convinced that the aircraft could be safely operated. A group of Boeing engineers and test pilots developed a simple approach: They created a pilot's checklist with critical action checks for taxi, takeoff and landing. They believed that this airplane was not too complex to fly, but was too complicated to be left to a pilot’s memory.

The impetus for creating the pilot checklist was to simplify a complex process. Surgeons similarly use checklists to maximize the safety and care of their patients. It is not that pilots and surgeons could not carry out their duties without a checklist. Checklists do not guarantee success or eliminate risk. Rather, a checklist helps to maximize the probability of success.

Why Do we Need a Checklist?

The most important thing (I hope Howard Marks didn't trademark this phrase) in investing is minimizing risk. Not the "risk" we learn about in school or is talked about in the media i.e. volatility. I'm talking about real risk - permanent loss of capital (i.e. crashing a plane or losing a patient). Despite what some may think or have experienced over the past few months, investing in the public markets is hard. Why? Because the market is a complex adaptive system in which some of the smartest minds (human and machine) compete every day to achieve the holy grail... alpha. For those not familiar with the term, alpha is simply excess risk-adjusted return over a stated benchmark (i.e. the market index). It is a measure of a manager's true stock picking skill. But what is a complex adaptive system (emphasis mine)?

A complex adaptive system has three characteristics. The first is that the system consists of a number of heterogeneous agents, and each of those agents makes decisions about how to behave. The most important dimension here is that those decisions will evolve over time. The second characteristic is that the agents interact with one another. That interaction leads to the third—something that scientists call emergence: In a very real way, the whole becomes greater than the sum of the parts. The key issue is that you can’t really understand the whole system by simply looking at its individual parts.

Michael Mauboussin, Harvard Business Review

How does this relate to the stock market? In the words of the great John Maynard Keynes (emphasis mine):

Or, to change the metaphor slightly, professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.

The General Theory, Ch. 12 (h/t Farnam Street)

I will go into more detail surrounding the dynamic nature of the market in later newsletters. The point I want to get across here is that the market is complex and making mistakes can result in real risk. If checklists helped to drastically lower the error rates and risk of pilots and surgeons, why wouldn't we, as investors, use checklists to minimize risk - permanently losing capital? In this context, using a checklist is critical to investing success. Additionally, focus and discipline are two common traits of the most prominent investors - a checklist is how I maintain these two principles.

SCM Investment Research Process / Checklist

Overview

I first started using a checklist as an analyst / associate in my private equity days. Given our core financial model consisted of three separate tabs / models (consolidated, operating company, and property company), each ~17,000 lines long, across 50+ assets - there was a lot of room for error. We minimized this error by creating error output checks and a checklist of everything that needed to be done to build and finalize a model. As I've stated, I try to bring my a private equity lens to the public markets - an investment research checklist is one way I am doing so. Please note that what I am providing here is just the main points of my process and does not include much of the granular detail. The biggest change in mindset that I am still working on is this: I am a stock analyst, not a company analyst.

Checklist Areas of Focus

I will provide some detail behind each of these areas of focus that comprise my holistic research checklist (note: this is separate from my investment management checklist i.e. buying and selling):

Idea Generation: How I determine which industry, theme, or company to research

Industry / Business Model Quality: Understanding industry dynamics, trends, business models, competitive intensity, food chain

Company Identification: Some quantitative and qualitative criteria I look for and why

Critical Factors: Determine few main drivers of company value / stock price and associated catalysts

Company Deep Dive: Develop holistic understanding of the company by digging through SEC filings, earnings call transcripts, and investor presentations - focusing on critical factors

Ensure Understanding of Business Model: Answer certain questions based on research

Management Quality: Compensation structure, incentives, decision making, history of success

Financials Deep Dive: Line-by-line understanding of the financial statements and accounting policies; comparing margins, growth rates, capital structure, etc. to industry peers

Scuttlebutt: Reach out to management with questions; industry experts for more insights

Model and Valuation: More historical financial analysis, build projections and scenarios, analyze historical / determine appropriate multiples, build comparable companies analysis

Important Investment Considerations: Determine the major misperception around the stock and why it exists, understand the risks and do a pre-mortem, market and stock sentiment, and timing

Technical Analysis: Is the stock at a high probability entry point?

The Pitch: Bringing it all together, synthesize the investment opportunity

Idea Generation

Almost every thought that you have is downstream from what you consume.

James Clear, Capital Allocators Podcast

The information age has resulted in an exponential increase in the amount of data in the digital universe. Think about this - 90% of the world's data was created in the past two years. This trend will only continue, as 2.5 quintillion bytes of data are produced by humans every day. Data proliferation has had many positive effects on our lives. However, one downside is that an increase increases the amount of "noise" we consume (more on this later). The Signal-to-Noise ratio ("SNR" or "S/N") refers to the ratio of useful information to false or irrelevant data. We want to maximize this ratio; however, the SNR declines with the more information we consume. As a result, I am highly selective and particular about what I read.

Some of the things I do to minimize the noise and find high quality potential ideas are:

Review stock charts (price and volume are objective)

Speak with select investors I respect / read their newsletters

Read high quality websites / blogs: Stratechery, TechCrunch, TechMeme

Read through 13-Fs of certain successful funds

Create information hub for company and sector information: Your broker should have this capability - this is very important

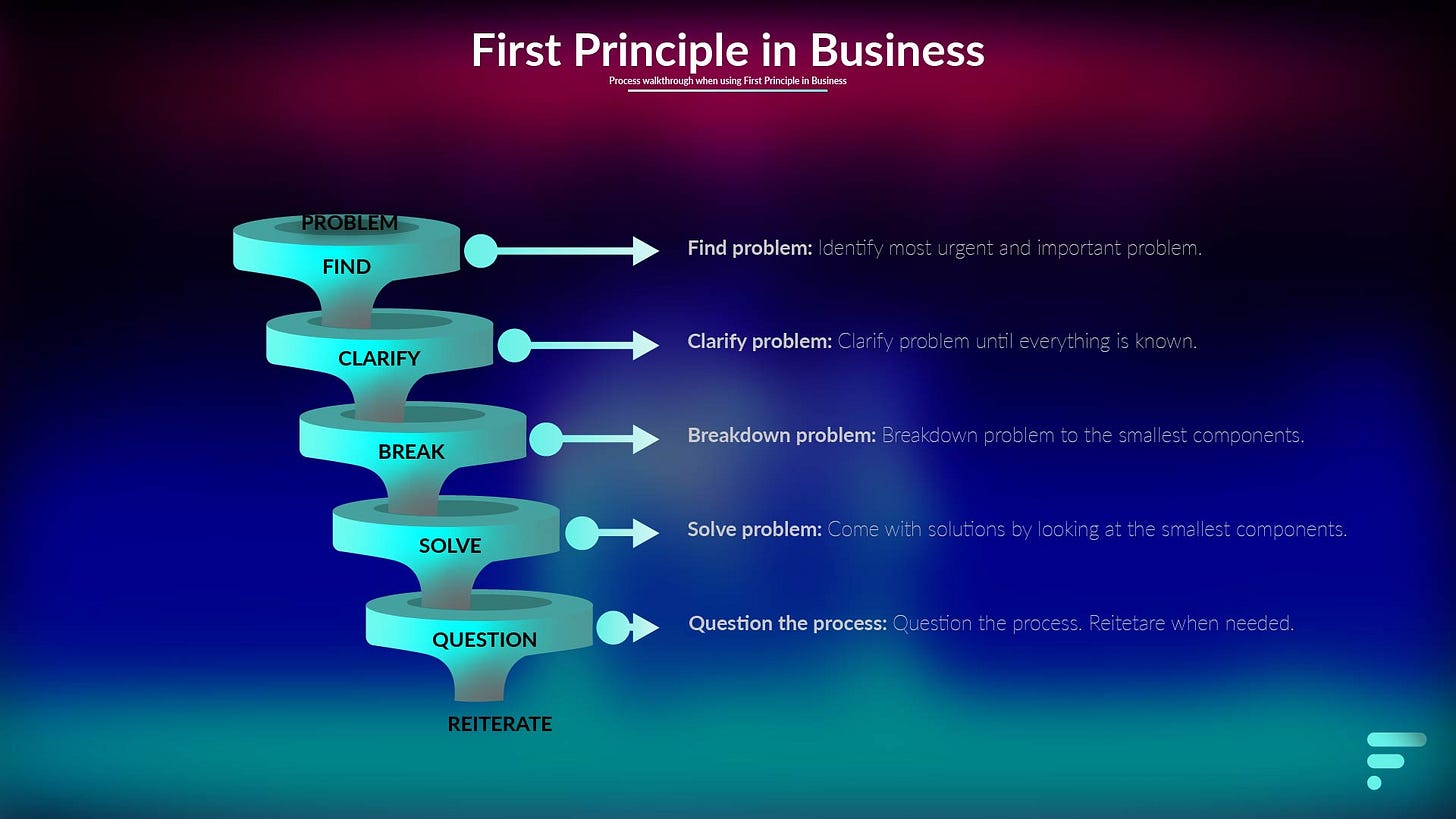

As you can see, I spend A LOT of time reading. All of this reading is meaningless until I spend time thinking and reflecting. Here is where mental models come into play for me. I attempt to have a clear understanding of the current state of the world by thinking in First Principles. So, what do I know to be true that is free of any assumptions? I find the complex problems and reduce them down to an "essential puzzle" that can more easily be solved. The result is an industry, trend, or even specific technology / product / service that I think can create a lot of value. I also go through a process of thinking about second and third order effects to develop an understanding of how I think these trends can evolve in the future.

Industry and Business Quality

Now I have identified a theme, industry, or technology that I think is attractive. The next step is to do a lot of homework on the topic. I take a Feynman Technique (Algorithm) ("FT") approach to learning the subject:

Choose a concept I want to learn about - already done above

Pretend I am teaching it to a ten-year old

Identify gaps in my explanation; Go back to the source material, to better understand it.

Review and simplify: repeat until I feel I have mastered the material

The first step I take is to fully understand the technology or the tech stack. There are certain technology experts that do a pretty good job explaining the basics to us non-experts. I read through their write ups and reach out to ask any questions / confirm my understanding of the subject after applying the Feynman Technique.

I move on to understanding the industry once I have a firm grasp of the underlying technology. The sources I use to perform the industry research are:

S-1s, 10-Ks, Proxy Statements, and investor presentations of leading companies in the industry

Basic Google search (search "[industry] primer" or other variants)

Industry trade journals and reports

Sell-side analyst reports / substack newsletters

I prefer to use the primary sources above, to not influence (bias) my thoughts

Some of the key questions I am trying to answer through my research:

What are the barriers to entry ("moats")? How can a company develop a durable competitive advantage?

Who has the power (Porter's 5 Forces) - customers, suppliers, competitors, regulators?

Is this a good business? What is the typical business model?

Who are the major competitors in the industry?

What are the key success factors to superior performance in this industry?

Define the market opportunity. How do competitive products address this opportunity?

Who controls industry pricing? Does the industry / competitor control pricing?

What kind of reinvestment capital is needed to grow?

How is the business and industry changing?

What is the historic and current rate of success in this business?

What are the major risks to the business plan?

How (and how much) can a good company differentiate itself from a bad one?

Finally, I conduct an industry / sector analysis based on my own custom-made peer group. The basic analysis consists of: 1) Historical peer group financial metrics, 2) Historical peer group outperformance / underperformance compared to broader market indices, 3) Food chain analysis, 4) Historical industry capacity and demand (and pricing) if applicable. This requires me collating a vast amount of data from disparate sources; something I continue to optimize and automate. For clarity, a food chain analysis isn't something that, for example, shows a company like CrowdStrike eating its competition. Rather, a food chain analysis is created to understand how upstream or downstream factors impact the companies in the industry. What I am doing is developing a complete understanding of the major suppliers (of inputs) and customers (buyers of outputs) for these companies.

Company Identification

Now that I have a thorough understanding of the industry landscape, I can focus on finding the company I believe has the highest probability of generating outsized forward returns. It is important to realize that rarely does a company "check all the boxes". If it does, I recommend digging deeper to see if you missed something or to confirm your conclusions. At a high level, I am looking for superior businesses, excellent management, bargain valuations, contrarian, LT capital gains. Some of the quantitative and qualitative criteria I look for are:

Durable Competitive Advantage / Moat: Unique value proposition with high returns on invested capital

Utilize Porter's 5 Forces here

Superior Product / Product Market Fit: What opportunity in the market does the company address? Why is their solution superior? What is the customer experience?

High Quality Management Team: High integrity, visionary, founder-led CEO. History of success, substantial ownership in company ("skin in the game"), attracts world class talent that specializes in the company's space. Management must obsess over the consumer experience

Excellent / Improving Unit Economics: Where is the company at in its business lifecycle? Are there opportunities to improve margins with scale? What is the stabilized margin profile?

Efficient, Frictionless Go-to-Market and Land-and-Expand Strategy: It should be easy to attract new customers (e.g. free trials) and easy to onboard these customers (quick setup / time-to-value)

Rapid Revenue Growth: +40% YoY past few quarters and CAGR over past 3-5 years

Recurring Revenue: Look at dollar-based net retention and sales efficiency

Sticky Solution: The company's platform / product / service must have some features that hook into customers, making them not want to leave (i.e. lower churn)

Innovation: The company is highly focused on product innovation, spending significant capital on R&D. Needs to show history of successfully rolling out new products and customer acceptance of them.

Industry: Top performing industry, large and expanding TAM. Company still has small piece of the pie but is continuously gaining share from incumbents, while expanding SAM and SOM.

Company should be the top one or two companies in the industry

Rapidly Improving Metrics: Both financial and operating metrics; operating leverage should lead to increased profitability (lower expenses % of Rev) with economies of scale. There should be a clear path to high sustainable free cash flow margins (if not already), target 30%-40%

True Cash Flow: Calculate four separate metrics: Gross CF, FCF, CF of Corporate Structure and Working Capital CF

I want companies with 1) high operating returns, 2) negative working capital (which is essentially free equity), and 3) relatively low reinvestment requirements

Pricing Power: Companies with pricing power have the ability to maintain their profitability during periods when input prices are rising or falling. Focus on cash gross profit margins (excluding depreciation) over time (stable is best)

Customer Diversification: No customer should make up more than 10% of Revenue or AR

Balance Sheet: Negative Net Debt (Cash > Debt); appropriate leverage can enhance returns

Low CapEx / Funding Requirements

Customer's and Employee's View of the Company: Does the company have a leading NPS? What do employees say about working at the company (Glassdoor ratings)

This checklist of criteria is helpful. But at the end of the day I am really just trying to find a company that is solving a big problem in a unique and superior way to existing methods (or is continuously at the forefront of innovation). The company's solution must have a moat and the management team has to always prioritize the consumer experience. How the consumer feels when using the product has a meaningful impact on customer retention and company success. Think about the difference between opening up an iPhone vs. Android phone - it matters.

Critical Factors

The process by which I go about analyzing a company and determining its critical factors is arguably the most important piece of my research. As I mentioned above, I want to focus primarily on the very few things (usually no greater than three) that drive a stock's performance. Once again, this is a priority because the goal is to analyze the stock in which I am investing, not the company. Focusing primarily on the critical factors allows me to maximize my time ROI which is extremely important given the amount of work that needs to be done.

Let me first define a critical factor. A critical factor has the following characteristics:

Occurs during the my investment time horizon

Has an associated catalyst that, when triggered, will cause the factor to become a greater opportunity or risk in the view of market participants.

In most instances, this factor causes one or more of the following:

Material changes in earnings or cash flow growth

Material changes in returns

Material changes in the probability the company: 1) makes an acquisition, 2) is acquired, or 3) there is a change in senior management.

Material changes in volatility profile of stock

To summarize my process to determine a stock's critical factors and associated catalysts:

Develop a system to compile the critical factors (and their catalysts) for each company or sector. I personally use OneNote.

Identify and understand historical (ideally +10 years) causes of anomalies or fluctuations to each company's:

Financial metrics: both absolute and relative to its peers

Valuation levels: relative to its peers and the market

Note: this is similar to the sector / industry analysis, but at the company level

Record the events that caused historical anomalies as factors (on a company or sector level) as well as the catalyst that triggered the event

Example: Strong customer pricing is the factor, while the catalyst is an upside surprise at the company's upcoming quarterly earnings release

Review current valuations to identify what's in the stock (current expectations). Record the factors that drive key assumptions necessary for each company to achieve consensus

Rank the recorded factors in terms of impact on earnings and cash flow over a reasonable investment time horizon (e.g., 6 to 12 months)

General rule: a critical factor should cause a > 5% change to EPS or CFPS estimates

Identify potential catalysts for the more significant critical factors

Remember: Critical factors should be identifiable and forecast through detailed research and have associated catalysts

Monitor network of information sources to forecast the catalysts for max 2-4 critical factors

Over time, add new critical factors and remove old ones based on their probability to move EPS or CFPS by a threshold (i.e. 5%)

By the end of this process, I have identified the 2-4 items (critical factors) I will focus on and prioritize through the rest of my research. This is difficult mentally for a lot of analysts (myself included), as there is a cognitive desire to know everything about a company. But at the end of the day, a PM (or yourself) is concerned solely with what will drive the stock. I have talked about the role Occam's Razor plays in my approach; this is what I am referring to. I only want to focus on the very few things that will have the largest impact on the stock (think Pareto's Principle). Otherwise, it becomes significantly more difficult to track not only if your thesis is playing out, but also why your thesis is / is not playing out. There is a real elegance and value to simplicity.

Company Deep Dive

There are many hedge funds out there that spend many months researching a specific company. I don't think you have that kind of time. So, I am going to try to simplify the company research aspect of my process as much as possible so that it can be of use to you. Let's dive in.

Focus Areas and Main Questions I am Trying to Answer

General areas of focus:

Revenue & Breakdown by chosen segmentation

Key Business Relationships

Key Business Risks

The main focus of my research revolves around the company's revenue drivers:

How does the company make money? I cannot invest in a company without being able to answer this basic question

How does the company define it's revenue-producing segments? This gives me insight into what Management thinks is important & how they are situating biz competitively for present and future

How does the company plan to compete in the marketplace?

Some of the key questions I am thinking about and trying to answer:

What is the crown jewel of the business? I want to identify the cash generator / main earnings driver. This is known as the "Cash Cow". A Cash Cow is required to generate and develop other high growth areas (think Amazon, Google, Sea Ltd. etc.)

What is the major growth generator (possibly the company's "moat")?

Normally management will highlight major growth areas in a particular segment

I look for areas where sales as a % of Total Revenue has increased over past few years. That is where growth may be coming from or to make up for declining / negative growth of Cash Cow.

What are the key risks? This is as important as determining catalysts to growth of another segment

Specifically, what are the key risks for the Cash Cow and growth generator? I look for commentary on expansion plans regarding the growth engine and market share / other revenue losses regarding the cash cow.

What is the downside protection ("Margin of Safety")?

Sources

Always use primary sources for initial research, including:

SEC / Regulatory Filings: S-1, 10-K, 10-Q, 8-Ks

Company Investor Presentations and Earnings Call Transcripts

Investor / Analyst Days and other Corporate Presentations

Secondary sources include:

Sell-side analyst research

Utilize information hub for articles from reputable sources

Glassdoor / product review sites

10-K Analysis

It is especially important to read through the 10-K if you are new to the company and industry. I recommend also reading through the past couple of 10-Qs, as well, but the 10-K should be your starting point given the wider range of information provided by the company. With that in mind, I would approach analyzing the 10-K in the following manner:

Business Description

Cover Page: Fiscal Year End, Headquarters Location, Shares Outstanding, etc.

History of the Business

Business Overview

Look for changes in company's defined and reportable segments (functional vs. geographic)

Selected Financial Data

Briefly look at actual performance of the business

Understand recent growth trends on important line items

Understand high level margins and anything else that sticks out

Look for any large one-time charges (a year where there may be a dramatic change)

These are items that quantify ideas of business risk, should be addressed in the MD&A

Management Discussion & Analysis (MD&A)

Important aspects of MD&A to focus on:

Important operating metrics that management uses to gauge performance

Any non-GAAP accounting that might otherwise come across in an earnings release

Understanding the cash position of the business and seeing where any cash burn might come from

Play role of operator of a competitor and try to scrutinize management's positions on everything they explain

Section helps provide some outlook and gives better visibility / confidence in any projections for the operating model

Factors to evaluate management (performed in more detail later)

Are they skilled operators?

Do they have capital allocation expertise?

Do they have industry-leading vision?

I want to talk about the section on Risk quickly. You all know risk is the most important thing I focus on. I don't recommend skipping the section on Risks, but I also don't recommend reading every single line. A lot of this section is somewhat boiler plate that you will find across companies (they all have to inform us that an economic recession is a risk to the business... you don't say!). This is a result of the General Counsel and other lawyers ensuring the company protects its own... backside. Nonetheless, keep an eye out for company-specific risk factors, especially those that may impact 1) the Cash Cow or growth engine discussed above or 2) critical factors.

10Q, Earnings Call Transcripts, and Investor Presentations

After the 10-K, I would read through the past couple of 10-Qs. Keep an eye out for any details on adjusted earnings or cash flows. I am making sure that (if I don't have access to a trusted resource) I am building a table of adjusted, non-GAAP metrics and the associated crosswalk to GAAP figures.

Then move on to reading the past couple of earnings call transcripts. I will also listen to the calls (1.25x-1.5x speed), but I find this method to be a lot faster than listening to the entire call. Remember, I am trying to maximize the ROI on my time spent. The prepared remarks from the company executives are well and good, but I find the real value in the Q&A with analysts (if they ask high quality questions). Understand that a lot of what these analysts are trying to do is build a mosaic of information to build out their models. This is very helpful for you! I like taking notes and marking up the printed out versions; creating questions myself as if I am participating on the call. This active reading helps me with overall retention and critical thinking.

Investor Presentations are a helpful source to quickly collate a lot of data. The graphs / charts can also be utilized for my own presentations. I should have collected all of the information in these presentations from the sources above, but this is a good way to make sure I am not missing anything important.

Business Model

Now that I have a robust understanding of the company, I want to ensure I have a thorough understanding of its business model. I am continuing to build a latticework of mental models for understanding certain business models i.e. aggregators (platforms), SaaS, etc. If I am analyzing a company that has a business model similar to others I have studied, then I am ahead of the game and have a pretty good understanding of what I am looking for. I tend to ask myself the following questions to make sure I know exactly how the business operates:

What is the selling model and the Go-to-Market ("GTM") strategy?

The most important thing for me is to be able to easily describe the entire sales process from order to fulfillment

Understand how the sales organization is set up and who the target customers are

Is it a recurring revenue / SaaS model?

What is the exact pricing model? Is it per-seat, usage-based, freemium, a combination?

What are the economics of the base business unit? How does it compare competitors?

Understanding unit economics is critical to develop a framework for the company's path to profitability and sustained high returns on capital

Why is the company good (or bad) at what they do? Can they sustain it?

Probably my favorite question for every company. Why would a customer choose them over a competitor? This is figuring out the company's "secret sauce".

Is this company growing by acquisition? How sustainable is that?

I always check Goodwill on the Balance Sheet. I'm not a fan of company's that need acquisitions to grow (there's a difference between needing and enhancing)

Also, this research piece by Wes Gray shows a strong negative relationship between the growth of total firm assets and subsequent firm stock returns

Important Factors of Performance

Does the company have a competitive advantage (Normalized ROIC > Cost of Capital)?

What are the company's reinvestment opportunities in the business and is it profitable?

Highly diversified customer base or on the path there

Once I have established a deep understanding of the business, it's time to analyze one of the most important aspects of a company: management.

I hope this first half of my research process whet your appetite for more. Next week will feature how I determine management quality, approach modeling and valuation, and finally - how I synthesize all my research into a stock pitch.

Onwards!

Great report, I really enjoyed reading that as felt extremely clear about the processes and splitting out key items from the noise. Great work 👏🏾👏🏾👏🏾