How to Determine and Invest in Different Market Environments

Identify General Market Tops and Bottoms

Hi Everyone,

I think you all are going to enjoy this newsletter and hopefully have actionable takeaways. Below you will find my process and strategy for identifying the type of market environment we are in at any point in time. I expand on this framework by providing insights into how to invest in each type of environment. While I don’t know it all and am not a market-timer, understanding the state of the market is a critical part of my investing process. This process constantly evolves as I learn, make mistakes, and experience success. For convenience, you can view the post on my website.

The next newsletter will be a detailed company analysis, including a thesis-driven executive summary, company overview, and financial model. This newsletter will be for paid subscribers only. You can sign up for the paid version on my main page (button below).

Finally, I am excited to announce that I am organizing the first FinTwit Summit with Dhaval Kotecha. This tweet provides a lot of the details, or you can click the “FinTwit Summit” link to visit the website. You can register for the event here. All of the early bird and early rider tickets have sold out, but you can still get tickets for only $15! All ticket proceeds will be used to fund the event and the remainder will be donated to St. Jude Children’s Research Hospital.

The event will take place in 1.5 weeks, the weekend of March 20-21 (Saturday-Sunday). The virtual conference will feature 45min - 1-hour speaking sessions by 14 of the best investors on Twitter. Even more exciting, the great Morgan Housel has agreed to be our keynote speaker (9:00am on Saturday, March 20th). Morgan is the best finance writer of our generation, most recently publishing his book “The Psychology of Money,” which is a must-read for any investor. The video recordings of all speaking sessions will be available after the event for everyone who purchases a ticket. So, it doesn’t matter if you are located halfway around the world or unavailable that weekend, you will be able to acquire the vast array of knowledge that the speakers will provide.

Please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve the risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Introduction

I have been inundated with questions about how I have been handling the current market correction when it comes to managing my portfolio. I have talked about having a rules-based investment process in this newsletter. The main benefit is to mitigate subjectivity and cognitive biases that negatively impact our decision-making. While I am by no means an expert and have the benefit of not having LPs (limited partners) to answer to, my approach to actively managing a portfolio has demonstrated success historically. To be clear, I believe there are many different ways to make money in the stock market. I am not one to say which method is right and which is wrong. The system I discuss below is simply what works best for me. The majority of the information contained in this newsletter is further explained on the Investors Business Daily website, where I was able to procure and refine a lot of what I discuss here.

Many of you may view this as market timing. I disagree. Rather, it is an extension of my approach to investing based on objective rules and probabilistic outcomes. I discuss the history of the process I attempt to follow and how it is based only on empirical market outcomes. Note, there is no perfect investing system. But nothing in life is perfect. So, I am heavily in favor of investors having at least some form of a system. This system should align with an investor's personality and both their ability and willingness to bear risk. I continue to refine and develop my own process; learning from mistakes and always being open to other ideas and concepts. To be clear, the idiosyncratic characteristics I discuss don't scratch the surface of my fundamental analysis framework.

A final thought on the system I follow. There is an added benefit, that it allows me to dynamically create optionality by raising cash. My comment in the tweet below is a concept I first learned from Dennis Hong from ShawSpring Partners. I agree with the well-known market adage that "time in the market matters more than timing the market." However, this applies to the broader market (or market indices) rather than individual stocks, which I will elaborate on below.

The O'Neil Methodology

A History of Success

The CAN SLIM investing system was developed by Bill O'Neil in the 1950s. He studied the best-performing stocks in the market and compared the characteristics of each to the average stock. If I could summarize his objective, it was to identify a common set of indicators for when 1) to buy a stock because it is most likely to experience large price appreciation and 2) to sell and lock in profits. This study now dates back to the 1880s and has culminated in seven characteristics shared by the market's big winners. These seven characteristics are represented by the acronym CAN SLIM, which provides an indication of which stocks to buy. This post is not about the entire system, but rather one component of it. However, I wanted to provide a brief overview of the framework for your understanding, below.

CAN SLIM

C- Current Quarterly Earnings Growth: The first characteristic looks for is high and accelerating EPS growth in the most recent quarter. We need to define "high" as 25% or more. Ideally, a stock will show greater than 40-50% EPS growth. This EPS growth should correspond with sales growth tracking similar levels. Companies can enhance EPS by (among other things) cutting expenses, which would negatively impact future earnings. Demanding high revenue growth along with EPS growth somewhat mitigates this underlying phenomenon. Finally, high ROE (>17%) indicates a competent management team that is able to generate high returns on stockholder capital.

A - Annual Earnings Growth: This is an extension of the above "C" - this time we require three years of EPS growth in excess of 25%, but the best companies usually produce growth much higher than that. In part, requiring annual EPS growth solves the potential issue of cutting expenses to grow EPS noted above. Additionally, accelerating annual EPS growth can be part of an S-curve analysis. Similar to above, I would look for corresponding strength in sales, margins, and ROE among other things.

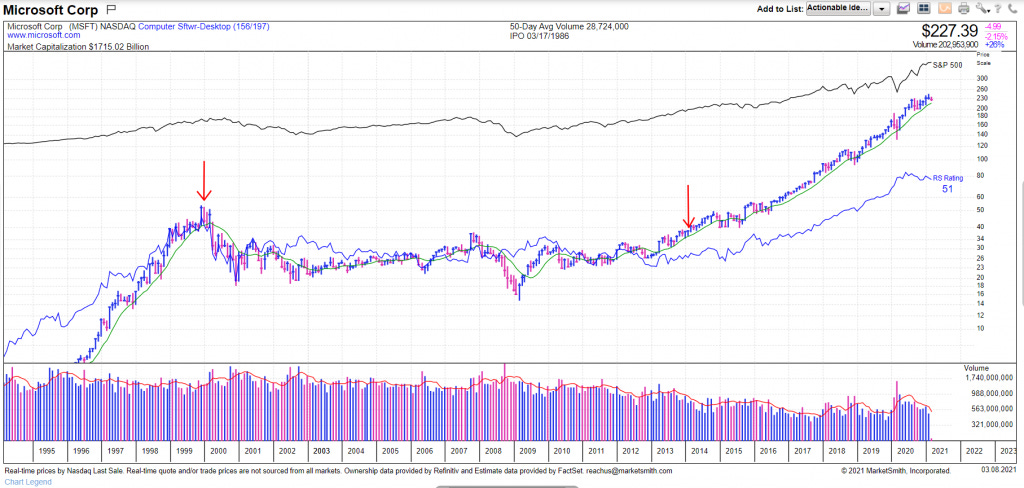

N - New Product, Service, Management, or Highs: A new product or service that could shape an industry or even create a new industry provides a catalyst for high earnings and sales growth. One example would be Apple introducing the iPhone. A new management team could transform a company's trajectory like Intel shareholders are hoping for with the recent hire of Pat Gelsinger. A tangible example is Satya Nadella taking the helm at Microsoft to replace Steve Ballmer in 2014 (second red arrow below). In Ballmer's 14 years (starting at the first red arrow below) as the Microsoft CEO, the stock returned a whopping... ~-27%!! That's hard to do. Meanwhile, Microsoft shareholders have experienced a 29% CAGR in the share price, or a cumulative 494% gain. That's a stark contrast, wow. Finally, new highs relate to the momentum effect, where stocks performing well (and making new highs) tend to outperform over the following year.

S - Supply and Demand: Price action in the stock market is simply a representation of supply and demand at any particular moment. A stock price goes up when demand for shares outpaces supply and vice-versa. Investors can get an indication for supply and demand by analyzing average daily trading volume on up versus down days. Share price appreciation accompanied by above-average volume indicates institutional demand for the stock. Institutional demand is important since institutions account for ~70-80% of volume in the market. Heavy institutional buying is known as accumulation, which should be seen at infection points in a stock like breakouts from base formations.

“Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks, and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

– Stanley Druckenmiller

L - Leader or Laggard: The best stocks tend to be leaders in their industry and part of a leading (top 50) industry. The stocks should show high (greater than 80) relative strength and/or rising relative strength near all-time highs ("ATH"). Relating to the comments on supply and demand, and the following notes on institutional sponsorship, these money managers are attracted to the best companies with the most promising prospects. Remember, the market is a forward-looking discounting mechanism. It follows that these managers want the best of the best. Given that capital is a scarce resource, you should hold the highest standard for companies in your portfolio to receive an allocation from your capital base. The best of the best are market leaders.

I - Institutional Sponsorship: "Institutional sponsorship" refers to stock ownership by mutual funds, banks, pension funds, and other large institutions. As mentioned above, institutional buying and selling account for roughly 70-80% of market activity. You want to look for an increasing number of funds owning the stock each quarter. The 3-5 year return profile of the funds provides an indication of fund quality. You want to see the best funds owning the best companies. Not only do these funds provide fuel to drive the stock higher, but these institutions will also step in to support the stock when it experiences selling pressure. An important characteristic is a stock's average trading volume. It must be sufficient (liquid) enough (>~400K) for an institution to manage its position. Additionally, the total float must be big enough (>25MM shares) for these funds to maintain a meaningful position due to the pure size of the fund. It takes time for these funds to build a position (days, weeks, months) because of the number of shares it must buy to build the position.

M - Market Direction: The seventh and final characteristic of the CAN SLIM system is the topic of this newsletter. The market direction is a binary factor. Stocks should be bought when the market is in an uptrend, stocks should not be bought when the market is in a downtrend. Research indicates that the market direction drives 75% of a stock's movement. I often discuss how investing comes down to analyzing and playing probabilities. You put the probabilities in your favor by buying stocks when the market direction is up. Under this system, there are three different market outlooks:

Confirmed Uptrend: In an uptrend, investors should buy stocks with strong fundamentals breaking out from consolidation/base patterns. This is when you have the highest probability of success.

Uptrend Under Pressure: In this market, investors should be cautious with buying stocks and make sure that the stocks in their portfolio are acting well or showing strength. This market also presents opportunities to lock in some gains.

Market in Correction: The market is currently in a correction (3/10/2021). I personally don't buy stocks during a correction because of the probabilities I mentioned above. Risk management is always important, so it is critical during these markets to cut losers quickly and make sure that your winners don't round-trip. I personally use this opportunity to build out research and develop watch lists of companies I believe could take market leadership in the next rally.

Market Direction and Analysis

What is the "Market"?

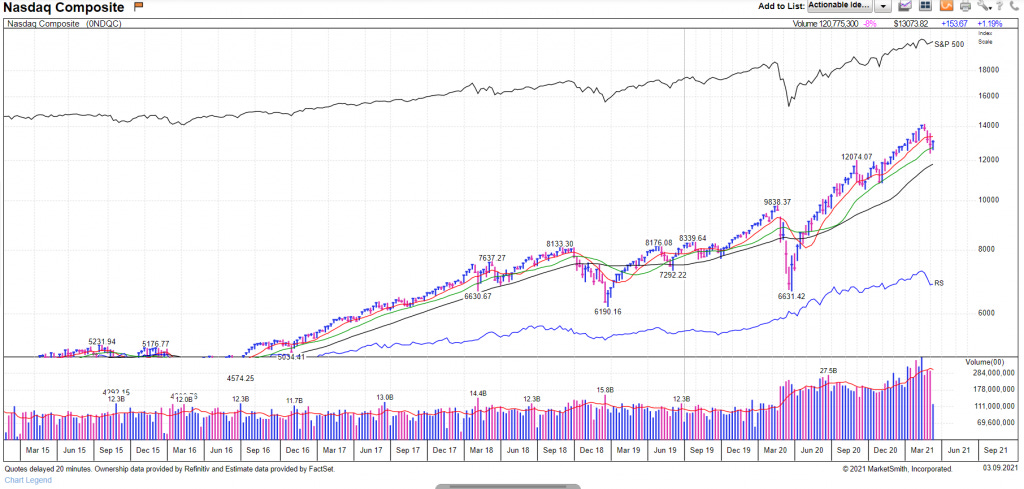

The market refers to the major stock indices. I specifically look at the Nasdaq and S&P 500. Starting your analysis with the market indices allows an investor to obtain an understanding of the general market trends. To be clear - as I do when looking at individual companies, I look at the indices on different time frames: daily, weekly, and monthly. Why is it important to use different time frames? For technicians, the insights gained prospectively depend on the time frame over which the analysis is performed. Analysis based on charts with [minute, hour, daily, weekly, monthly] time-frames attempt to determine what will happen over the following number of [minutes, hours, days, weeks, months]. Let me quickly provide an example.

Nasdaq (Daily): See the chart above. You can see the recent downtrend, corresponding to the "Market in Correction" status. Given how it seems the market found at least temporary support at its 100-day simple moving average (green line), it seems that an investor could take a bullish or bearish stance based on this chart. There is still a lot that remains to be seen in terms of what the market does next. I'm not a clairvoyant, so I, unfortunately, have no answers.

Nasdaq (Weekly): The chart below shows the market performance based on a weekly time-scale. While the daily chart showed some significant weakness in the Nasdaq, viewing price performance on a weekly basis shows a stronger current uptrend. Once again the 21-week SMA (green line, slightly different from 10-day SMA given the calculation base) is providing support for the market, which needs to hold to avoid further selling pressure. There is still uncertainty on the weekly chart but shows a more bullish trend off the March 2020 lows for investors focused on the Nasdaq. This trend looks like it may persist for many weeks into the future.

Nasdaq (Monthly): I added an arrow to the chart in case the long-term trend isn't blatantly apparent. The current pullback looks like nothing but a brief pause on the market's move up and to the right. The strength of the move has been strong and sustained off the March 2009 lows during the GFC. Sure, there have been relatively temporary breaks in this trend (Q4 2018 taper tantrum, March 2020 COVID). A lay observer would definitively say we are in a sustained long-term bull market. One note of caution I would point out is how the index has mostly hugged the 10 month SMA (green line) during this run. However, despite the recent pullback, the Nasdaq remains +10% above the 10-month moving average.

*I am not a technician, I am utilizing basic technical and trend analysis.

How to Determine Market Direction

Since we are already in a correction, I will start with how to determine with a high probability that the market is going into a correction.

Distribution Days: Distribution days occur when Nasdaq or S&P 500 are down more than 0.20% (this figure varies slightly) on higher volume than the prior day. These days are significant because they are a sign of institutional selling. While institutional buying is known as accumulation, institutional selling is known as distribution. The question is then how to use distribution days to determine market direction? There are three components of this trend analysis: 1) the number of distribution days, 2) the cadence/speed/frequency of distribution days, 3) the intensity of distribution days. What this means is that a build-up of distribution days on an index in a short amount of time often indicates a change from an uptrend to correction. To be specific, usually, 5 - 7 distribution days within a 4 - 5 week (20-25 trading day) period will mark this change in trend.

A distribution day is removed from the count the earlier of 1) the market closes 5% higher than the closing price of that distribution day or 2) 25 trading days have passed since the distribution day. To be clear, not all distribution days are created equal. A distribution day during which the market fell by 2% on volume 50% greater than the previous day is a stronger component of the distribution day count than a distribution day consisting of a 0.3% decline on volume just marginally higher than the prior day. *Note: volume does not have to be higher than average daily volume, just higher than the prior day.

The example below that I procured from Investors Business Daily ("IBD") illustrates how the distribution day methodology was used in 2007 to identify the market top in the Nasdaq before the GFC. What you should focus on is both the size of the down-day moves and the corresponding volume on those days. This is the intensity I referred to above. Additionally, notice how tightly packed together these days are, illustrating the high frequency of institutional selling. So, it is not about having just one day of heavy selling - one day does not make a trend. It is the build-up of these days which creates the trends.

While the accumulation of distribution days indicates when a market changes direction from an uptrend to a correction, follow-through days indicate a change in market direction to the upside.

Follow-Through Day (FTD): A FTD indicates a market correction has ended and a new uptrend has possibly begun. The follow-through day occurs after the major indexes have been trying to rally higher from a recent bottom. A follow-through is an up day in the market of at least 1.25% (this figure varies slightly) on rising volume which usually occurs on the 4th to 7th day of an attempted rally. Note - the FTD must occur on the fourth day after a market bottom or later. If the market undercuts a prior low, the day count resets. A FTD confirms the rally is working and the market trend is changing back to the upside. A follow-through day is an indication for investors that it is time to slowly start increasing exposure by buying strong fundamental stocks that are breaking out of constructive bases.

It is important to understand that a follow-through day has to occur at least four days after a market low during a market in a correction. I keep speaking about probabilities, so the question you should be asking is, "what is the probability that a follow-through day represents a change in the market's direction back to an uptrend?" It turns out that ~70-75% of follow-through days are successful - meaning they indicate the market is resuming an uptrend. This is why I said investors should slowly start buying stocks and getting back into the market, in case the FTD fails and the market reverts into a correction.

The analysis of determining when to get more aggressive comes down to identifying further institutional buying (accumulation) in the market and your leading stocks. A part of this analysis needs to include identifying further distribution days soon after a FTD, which could indicate a head-fake and a move back lower. In this scenario, I would act with extreme caution and strictly follow sell rules to continue protecting the portfolio.

Strategies and Actions

As discussed above, in this system there are three different states of the market that dictate how an investor should manage their portfolio. Here is a brief overview.

Confirmed Uptrend

Action Steps

Focus on Best-In-Class Stocks: In a confirmed uptrend, the market environment is generally constructive and presents a great opportunity to buy your highest conviction ideas. These companies should demonstrate strong fundamentals breaking out of a sound base pattern. You can read the article on my investing process to gain further insight into what I view as "strong fundamentals."

Follow the Process: As I mentioned above, every investor should have a process. While uptrends provide the highest probability of an investment working, nobody bats a thousand in this business. Knowing we will be wrong (a lot) makes it critical that investors will stay disciplined with their buy and sell rules regardless of the market environment.

High Bar for Portfolio Companies: With a concentrated portfolio and thousands of public companies, investors have the benefit of being able to have extremely high standards for the companies held in their portfolio. I personally underwrite a 25-30% IRR for companies in my portfolio. Always maintain that high standard.

Gradual Exposure After a Follow-Through Day: This was discussed in detail above.

Summary

Most individual stocks follow the general direction of the market. So, investors should be buying stocks while the market is in an uptrend. Put the probabilities in your favor. One thing to be aware of is that the market leaders in a rally usually build base patterns during a correction. These stocks then break out of a base when the market begins to rally and is part of the leadership higher. These are the stocks that tend to outperform the market and should comprise the watch list an investor builds during a correction.

Uptrend Under Pressure

Action Steps

Limit New Purchases: Increasing selling pressure in the general market, indicated by the increasing number of distribution days, should make investors hesitant about buying any new stocks. Any new purchases should be for stocks that meet an even higher bar of excellence that demonstrate a rare combination of strong fundamentals and technicals.

Defensive Portfolio Management: Knowing that the general market is coming under selling pressure, there are likely stocks in an investor's portfolio experiencing the same. The first thing I do is determine a price for each company I own at which I would defensively book at least partial profits. Having a set price at which I will sell removes any emotional pitfalls that would cause me to experience further losses. Pay attention to portfolio stocks falling on higher volume or where there are profits that are continuing to bleed away.

Flexible Discipline: When a market is in an "uptrend under pressure" the market could go either way. It's during these periods that it is highly important to be even more vigilant to ensure you are optimally positioned for the market's next move.

Summary

Market uptrends come under pressure over a period of time when distribution days start to build up. As these days start to build up, investors should become increasingly defensive in their positioning. It is important to stay flexible because the market could either continue its move to the upside or sink into a correction.

Market in Correction

Action Steps

No New Positions or Buying: Again, since 75% of a stock's movement is market-dependent, the probabilities of success are against an investor during a correction. Patience is a critical quality for investors to develop. Be patient, wait to buy stocks until the market moves back into an uptrend. Cash is a position. In a correction, "don't just sit there, do nothing."

Defensive Selling and Profit Taking: Investors should think about selling stocks that are showing weakness and continuing to sell-off. Even when a market is in an uptrend, I have a 7-8% max-loss rule. However, in a correction, it is perfectly reasonable to sell a stock at breakeven or even a small loss if it has been selling off with the market. Similar to when the uptrend is under pressure, I have target prices at which I will sell a stock if it falls to that level. This is important so that I don't have round-trip trades and turn a successful investment into a failure.

Stocks That Continue to Show Strength: No alarm bell goes off when a market enters a correction that demands investors sell all of their holdings. If a company's stock continues to show strength, why sell? If anything, this shows incredible relative strength juxtaposed to the market. However, investors should be aware that this strength can change quickly, so maintain the discipline and process discussed above by still having a selling price.

Build a Watch List: As I mentioned above, many of the leading stocks in a rally build bases during corrections. These stocks proceed to break out and rally when a market turns towards an uptrend. The only way to increase the probability that you invest in these winners is by building and tracking a watch list during corrections. The companies that make the watch list should be building technical bases and demonstrate the strongest fundamental profile. The company's story, competitive positioning, and leadership are non-negotiables - without strong fundamentals, there is no investment to be made.

Summary

Most stocks follow the indices lower in a correction, so making new investments presents an extremely unattractive risk/return profile. Therefore, it is important to be defensive and protective of your stronger stocks. Refer to Warren Buffet's first two rules of investing: 1) don't lose money, 2) don't forget rule number one. Having discipline during a downturn can make sure an investor doesn't break these two rules.

Conclusion

Every investor should have a disciplined system and process. There is no "correct" way to invest; I believe there are many ways to make money in the market. I manage my active portfolio (separate from my retirement accounts and long-term brokerage account) as if I am managing external capital for LPs. I want to practice how I will eventually play. As such, I am highly cognizant of investor risk aversion and the primary objective of preserving capital. Regardless of the system you use, the preservation of capital is always paramount. This is true risk mitigation.

While academia has defined risk as "standard deviation," my first question would be if standard deviation to the upside is truly risk? My view of risk is the set of known possible outcomes that investors can reasonably assign a range of probabilities and quantify the permanent loss of capital under those scenarios. This is different from uncertainty, in which there are unknown possible outcomes. My final quip with standard deviation is the underlying assumption of ergodicity when in reality investing occurs in a non-ergodic system - the stock market.

You all may have a lot of questions from this post, please feel free to reach out on Twitter. I wanted to culminate this article with some final thoughts and conditional statements.

Have a Process: I discussed my process in this article. I'm not saying it is the right way or the only way to manage a portfolio. It is the best way I know how to manage risk and capture upside through active management. You can agree or disagree with all or parts of my process. But what matters is that you have a process, not that you adopt mine specifically.

Active vs. Passive: The process described herein refers to how I approach my actively managed portfolio. My retirement account consists solely of ETFs and I DCA.

Probabilities and Objectivity: My portfolio management decisions are solely based on empirical probabilities. I follow a rules-based approach to remove emotions from my decision-making process, letting objectivity drive my actions.

Learning Process: I am constantly learning what works best for me and my personality. I update my process and rules when I get new information, either by making mistakes or experiencing success. I am still new to managing a portfolio and by no means have it all figured out. I will always be learning and refining my abilities, thank you for coming along for the ride.

*Note: I have been mostly in cash for the past few weeks because of the rules and process described above.