Hi Everyone,

I hope you all had a nice week. In this week’s edition of the Seifel Capital Newsletter, we will review an investment analysis of Fastly. Please reference the detailed analysis here if you would like to learn more. If you would like to read previous reports, you can access the Google Drive folder here. I anticipate building out these reports to include additional information as time permits.

Additionally, please note that I have not had the chance to incorporate Fastly’s acquisition of Signal Sciences (announced yesterday, 08/27) into this analysis. However, this bolt-on security acquisition for $775MM is exciting when considering the expansion of the company’s holistic solution.

Before we dive in to the analysis on Fastly, please make sure to share this newsletter, share this post, or subscribe (if you have not already) if you like the content! You can use the buttons here to do so:

DISCLAIMER:

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

With that, please enjoy this report on Fastly, Inc. (FSLY)!

Investment Overview

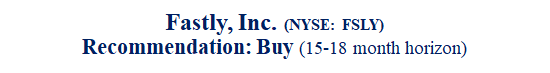

Executive Summary

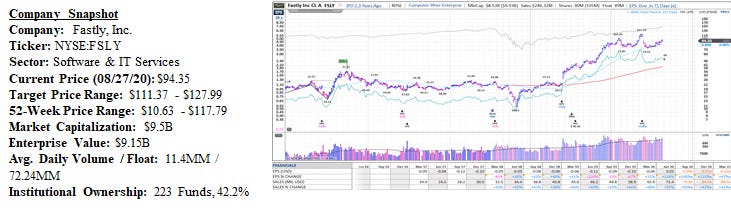

Fastly, Inc. (“Fastly” or “FSLY”) is the fastest growing company in an emerging high growth industry that is fundamentally changing the infrastructure of the internet. Before we begin, let’s address the common misconception that Fastly is purely a CDN, which has lead to doubt in the investing community as it relates to the company’s future prospects. The CDN market has become highly commoditized and it is difficult for companies to differentiate themselves. Founder Artur Bergman initially set out to create a better content distribution network (“CDN”), but the company has been entirely focused on edge computing since 2017. Edge computing is the logical evolution of CDNs and the internet infrastructure as a whole. Edge computing is a whole new ballgame! You can read about the difference between edge compute and CDNs in the detailed report.

The combination of the best performance platform, industry leading visionaries and engineering talent, and efficient business model has the company set up to achieve a sustained competitive advantage for years to come. The company is a pioneer in edge computing and customers agree that Fastly provides the best solution to provide fast, efficient, secure, and cost-effective processing of data and content to end-users. Continued adoption of its platform and best in-class expansion rates within the current customer base are evidence of the company’s success. In a world of immediate gratification and data proliferation, companies need a reliable partner that can scale its business needs and deliver premier customer experiences. Fastly’s solution does just that. The market is not appreciating the runway in the company’s growth profile and ability to expand margins into the future.

Company Overview

Fastly is a leading cloud edge platform. While it is commonly viewed as a traditional content distribution network (“CDN”), the company’s focus and core competency is in edge computing. Its developer-centric model is further bolstered by its programmable network with high quality performance and security. Fastly’s “mission is to fuel the next modern digital experience by providing developers with a programmable and reliable edge cloud platform that they adopt as their own.” It helps organizations keep up with complex and ephemeral end-user requirements by powering fast, secure, and scalable digital experiences. The company is able to meet the needs of its customers with its proprietary edge cloud platform. Fastly designed its platform from the ground up to be programmable and support software development requiring a flexible environment. Fastly’s platform gives its customers a significant competitive advantage over competition by increasing compute times, minimizing data loads, and providing developers with a dynamic tool set.

The Fastly platform consists of three components:

A programmable edge,

A software-defined modern network, and

A philosophy of customer (i.e. developer) empowerment.

Industry Overview

Market Opportunity

Sum-of-the-Parts Industry Analysis yields total market opportunity of approximately $18.0 billion in 2019, based on expected growth from 2017. It is expected to be $35.8 billion in 2022, growing with an expected CAGR of 25.6%.

Edge Computing: MarketsandMarkets estimates the edge computing market to be worth approximately $2.7 billion in 2019, growing to $6.7 billion by 2022 at an expected CAGR of 35.4%.

Content Delivery and Streaming: According to MarketsandMarkets, the web performance optimization market, which gives enterprises the ability to deliver online content to users securely and reliably, will expand from approximately $3.0 billion in 2019 to $6.6 billion in 2022, an expected CAGR of 29.5%. Over that same period, MarketsandMarkets predicts that the media delivery market, which focuses on reducing the latency time of delivering media content to end-users will grow from approximately $4.3 billion to $10.1 billion, an expected CAGR of 32.3%.

Cloud Security: MarketsandMarkets expects the market for WAF solutions to grow from $3.3 billion in 2019 to $5.5 billion in 2022, an expected CAGR of 18.3%, and the market for bot detection will grow from $0.3 billion in 2019 to $0.8 billion in 2022, an expected CAGR of 42.4%. IDC estimates that the addressable market for DDoS prevention will grow from $1.5 billion in 2019 to $2.4 billion in 2022, an expected CAGR of 17.8%.

Application Delivery Controller: Application Delivery Controllers determine the type of user or device requesting content and type of content being requested to make traffic management decisions. IDC expects this market to expand from $2.9 billion in 2019 to $3.7 billion by 2022, an expected CAGR of 8.1%.

Edge Computing and the Changing Industry Landscape

A detailed discussion of the following trends, competitors, and Fastly’s approach can be found in the detailed report. To summarize, the edge computing industry is changing based on the following trends:

Hyper-Connected End-Users are Increasingly Impatient: In the digital age defined by constant connectivity and instant gratification, recent research from the Pew Research Center shows that 39% of Americans aged 18 to 29 now go online “almost constantly.” According to a Google study, as page load times increase from one to five seconds, the probability of bounce (customer leaving) increases 90%.

End-Users Expect Instant, Personalized, and Dynamic Experiences Online: Personalized content results in increased sales and an increased likelihood of repeat purchases for Fastly’s customers. The increasing popularity of the mobile application, gaming, and live-streaming markets has fueled explosive growth in dynamic content. IoT, along with other technologies, will require companies to rapidly process large amounts of data closer to the end-user, or device, for instant, accurate responses.

End-Users Expect Privacy Even After Giving Out Personal Information: End-users expect companies to put sufficient security measures in place to guarantee the privacy of their data. Meanwhile, web and mobile applications are becoming an increasingly attractive target for attackers who use them as a backdoor into company networks. Web applications were the number one attack vector used to conduct data breaches in 2018, according to research from Verizon.

Enterprises Need to Reinvent Themselves To Compete

Organizations Must Embrace Digital Transformation to Stay Relevant

Digital Transformation is Driving the Growth of Hybrid and Multi-Cloud Deployments: IDC predicts that by 2021, over 90% of enterprises will use multiple cloud services and platforms.

Enterprises are Looking for Cloud Partners Who Can Scale On-Demand

Edge Computing is the Next Evolution of the Cloud: Gartner estimates that by 2022, 75% of enterprise-generated data will be created and processed outside a traditional data center or cloud, at the network edge.

Limitations of Antiquated Solutions

Limitations of Legacy CDNs

Legacy CDNs were not designed for developers or to address the rapid compute and performance requirements of today’s data-intensive applications

Lack of Visibility and Control

Outdated Architecture is Expensive and Limits Functionality

Sub-Optimal Technology for Live Streaming and OTT Video

Limitations of Enterprise Data Centers

High Total Cost of Ownership

Agile Challenges (Not Flexible)

Inability to Handle Attacks at Scale

Limitations of Central Cloud: According to Logic Monitor, 83% of enterprise workloads will be in the cloud by 2020.

Latency Issues

Inability to Scale

Vendor Lock-in

Business Model Hurt by Move to the Edge

Fastly’s Solution: The Developers Edge

Fastly’s powerful, serverless edge cloud platform is designed from the ground up to be programmable and support agile software development. Customers’ applications are processed and secured at the edge of the internet for enhanced performance and protection. Processing these applications as close to customers’ end-users as possible increases speed and overall security.

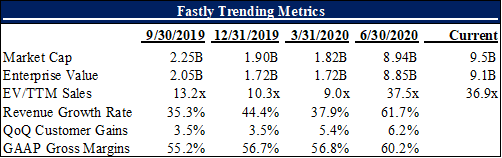

The company’s Edge Cloud Platform is called the Developer’s Edge, which has three core tenets:

Developers must be empowered to innovate

Platforms must innovate ahead of market demands while still being reliable, scalable, and secure; and

Vendors must provide exceptional flexibility and support.

The Developer’s Edge consists of three key components, as discussed in the executive summary: a programmable edge, a software-defined modern network, and a philosophy of customer empowerment.

The Fastly solution is superior because:

Programmability: The fully programmable platform allows developers to tap into Fastly’s user interface to address simple use cases.

Real-time Visibility and Control: Developers can make instant configuration changes and see the impact of those changes nearly immediately.

Consistent and Superior Performance: The platform design enables Fastly to cache dynamic content for long periods of time and retrieve it quickly so web pages load faster.

Support for Agile Development Processes: Developers can build Fastly’s edge cloud platform into their technology stack to power continuous integration/continuous delivery (“CI/CD”) efforts.

Scalability: Fastly’s software-centric approach and software-defined modern network are designed to enable enterprises to scale on demand.

One Network: The simple, compliant edge cloud platform is able to support enterprise customers’ security and delivery needs in a highly efficient manner.

Scalable Security: The network is designed to provide the scale needed to defend against DDoS attacks without sacrificing performance.

Large and Growing Developer Community: Developers are familiar with Fastly’s configuration language, which makes adopting its platform easier.

Partner Integrations: Full-featured APIs for seamless integration into any technology stack makes for easier partner integrations. PaaS partners can build on top of Fastly’s edge cloud platform to extend their offering to our customers, while logging and analytics partners can build hooks into our platform to consume our real-time logs

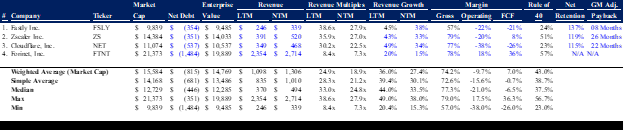

Main Competitors: Cloudlare ($NET), Akamai ($AKAM), Amazon ($AMZN), Microsoft ($MSFT)

Investment Thesis

Edge Computing is a New Paradigm: Fastly is one of the leaders and pioneers in edge computing, which is essentially changing the underlying internet architecture as we know it.

Importance of Satisfying End-User Demands: We live in a world of immediate gratification. As such, end users expect fast, reliable, and secure access to content and data. Fastly’s solution allows its customers and partners to provide this great digital experience to its customers.

More Data Requires More Efficient Computing: Data proliferation is a direct result of the digital transformation. Companies will need a solution that ensures peak performance, minimal latency, and reliable security. Fastly’s solution checks those boxes.

Customer Profile and Strategy: Fastly’s customers include some of the leading technology innovators in the modern era. Its focus on enterprise customers creates for a more efficient business model, reflected in Fastly’s best in-class 8 months return on customer acquisition costs.

Innovation: Fastly’s Compute@Edge solution is the latest product the company has developed, continuing its excellent tradition of innovation. Artur Bergman is highly respected as a leading visionary in edge computing.

Great Management Team: Artur Bergman founded the company in 2011, but recently stepped down from the CEO position earlier this year to become the Chief Architect - focusing on engineering and product development which is his specialty. He still owns over 10% of the company’s shares. Former President Joshua Bixby has stepped into the CEO role and is highly touted among the analyst community.

Customer Retention / Expansion: The company’s best in-class 137% dollar-based net expansion rate (DBNER) is a result of the company’s ability to land with customers and increase their spend over time. The company mentions that customers usually increase their spend by 3x (200%) in its second year with Fastly, and another 30% in the third year. Continued product innovation and sales execution will allow the company to maintain high expansion rates.

Industry Outlook / The Edge: The company’s continuous innovation and market leading solutions, coupled with strong industry tailwinds, will allow the company to sustain above average growth for many years and become an industry leading player. It is a pioneer in edge compute and should benefit from a superior solution.

Investment Framework

Critical Factors

1. Number of Enterprise Customers

- Market View: The Street seems to expect a dramatic slowdown in FY 2021 to ~10% growth, representing an end of year balance of only 380 (10% differential to SCM).

- SCM View: Ending FY 2020 with 346 customers would represent 20% annual growth over the FY 2019 ending balance of 288. This is a modest estimate give its FY 2018 and FY 2019 YoY increases of 34% and 27%, respectively. Additionally, SCM forecasts 20% customer growth in FY 2021 as a result of improved macroeconomic conditions and the rollout of Compute@Edge. This would would lead to an ending year balance of 422.

2. Enterprise Average Contract Value (“ACV”)

- Market View: Analysts seem to be expecting a slowdown in FY 2021 Enterprise ACV from 28.8% in Q2 2020 to ~15% in 2021 ($873K). There seems to be a disconnect between the company’s historical growth rates and compute edge developments against analyst forward estimates.

- SCM View: SCM estimates a 25% YoY increase in enterprise ACV for FY 2020, which would result in an ACV of $759K. This is a slight drop off from the 28.8% growth experienced in the latest period in tough economic conditions. It is FY 2021 growth that the Street misses the mark. Fastly has explicitly stated its intentions to go to market with Compute@Edge by November 2020, making the product available for the entire FY 2021. Additionally, the company continues to roll out new products and features (i.e. security), which will undoubtedly lead to continued extremely high dollar-based net retention > 130% throughout FY 2021. This would be consistent with the past number of years for Fastly. As such, SCM expects 25% growth in enterprise ACV, resulting in a FY 2021 ACV of $910K.

3. Compute@Edge Deployment

- Market View: The Street may be hesitant to price in any upside in Revenue for 2021 from the launch of Compute@Edge.

- SCM View: SCM is hesitant to price in significant upside in Revenue for 2021 from the launch of Compute@Edge due to a ramp in customer adoption. However, SCM is more bullish than the street as 62% of customers using the beta product already have an idea for how to use Fastly’s edge compute solution.

Conviction Level: Why SCM view is Right

1. Behavioral Advantage: Recent run-ups and subsequent sell-offs post-FY Q2 2020 earnings reports seem to have made analysts more conservative regarding the SaaS space and coming cloud adoption. This drags down estimates for all companies in the industry. Additionally, SCM believes the sell-off was an overreaction, given Fastly’s strong performance in the quarter especially relative to other SaaS peers.

2. Analytical Advantage: The company has rolled out new products throughout 2020, especially on the security side (not even including its recent acquisition of Signal Sciences, which is not contemplated in the valuation of Fastly in this report). This has allowed the company to maintain greater than 130% DBNRR for a long time, and will continue to do so into the future. SCM expects continued adoption and performance through 2021 and beyond as a result of the recent product launches.

What is the Market Missing? Why is There a Mispricing?

The market is underestimating the growth potential of Fastly and its ability to continue expanding both within its customer base and with new customers. This has resulted in a muted forecast of enterprise customer additions, flowing through to lower revenue estimates and associated price targets. There has been an error in the processing of information that has been made public through published press releases, conference call transcripts, and financial reporting.

Mispricing Impact:

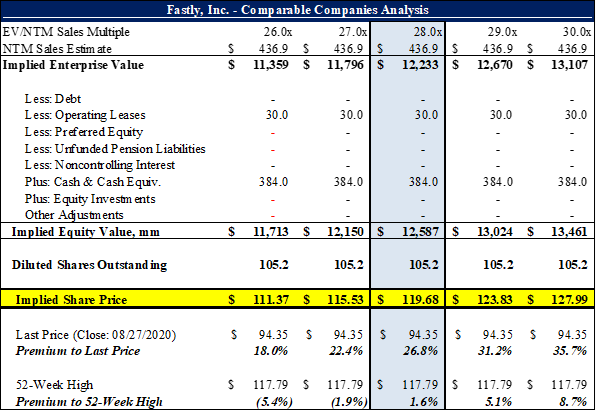

Enterprise Customer Forecast: The difference between SCM and Street estimated forecasts of 422 and 380 for the end of FY 2021 enterprise customers, respectively, is a net difference of 42 such customers. At an customer ACV of $911K (SCM estimate), this results in a FY 2021 Revenue difference of $38.3MM. At the median EV / NTM Sales Multiple of 28.0x, this difference results in a ~$1.1B Enterprise Value differential. This leads to a difference of ~$10.2 / share in forward price estimates.

Enterprise ACV Forecast: While the Street expects FY 2021 Enterprise ACV to come in around $873K, SCM forecasts an ACV of $910.5K for the year; a difference of $37.5K. Utilizing the Street’s estimate of 380 enterprise customers, this results in a revenue differential of $14.25MM. At a 28.0x EV / NTM Sales Multiple, this results in an Enterprise Value differential of $400MM, or $3.80 / share.

The Catalyst for Each Critical Factor (Calendar)

Number of Enterprise Customers: Q2 2021 Earnings Report – analysts will realize the company is going to handily beat Street estimates by the middle of the year.

Enterprise ACV Forecast: Q2 2021 Earnings Report – Same as for the customer forecast, the Street will need a couple of quarters to realize it is lagging behind on its Enterprise ACV forecast. Successful product adoption and rollout of Compute@Edge are key factors.

Compute@Edge Deployment: FY 2020 earnings call or a press release in November, when the company is expected to launch.

Risk / Reward

SCM sees the downside being that Fastly’s multiple contracts by as much as 20% to 23.0x, which would result in a price target of ~$99. This is a slight premium to the 08/27/2020 closing price of $94.35.

Additionally, SCM’s FY 2021 revenue growth forecast of 46.4% could be too aggressive. A downside scenario would be revenue growing only 35% over FY 2020, which would result in FY 2021 revenue of $399 (8.8% differential). At $399 FY 2021 revenue and a 28.0x median multiple, that would result in a price target of $109.6 / share. This is still above the current price and should not be a limiting investment factor.

Pre-Mortem and Who’s on the Other Side?

Investment in Fastly failed, what went wrong?

Market multiples contracted significantly.

Fastly’s rollout of Compute@Edge is significantly delayed or customer adoption is slow to ramp.

Fastly’s other new products failed to be as successful with customers as previous product launches, reducing product adoption, lower dollar-based net retention, and lower ACV.

The company is required to expand its POP presence due to more granular data requirements, eating into gross margins.

Major cloud vendors pivot hard to focus on the edge computing space.

The company suffers delays in rolling out more products.

More competitors enter the space and the product becomes commoditized.

Slowdown in the transition to cloud environments and applications.

TikTok revenue could be lost due to failure of U.S. firm to acquire it (representing 6% of revenue).

Who’s on the other side of the trade and why are they selling? Why could they be right and SCM be wrong?

Institutions seem to have sold the stock after earnings, but the stock has rallied 30% off its low of $72.55 after Q2 2020 earnings. Additionally, the ownership profile is still extremely attractive and the management team has skin in the game.

Valuation may have gotten too far ahead of itself, which will require multiple contraction. We have modeled this scenario above and believe the company will still be able to grow into its multiple.

SCM’s belief in Fastly’s ability to differentiate itself through a superior solution and best-in-class go-to-market strategy may be overstated. The CDN space became highly commoditized, could the same thing happen in edge computing? This seems unlikely, and if anything would take a few decades, as it did with CDNs.

The market could have the fundamental belief that Microsoft and Amazon, specifically, will make massive investments in the Edge@Compute space and take market share. While both use Fastly’s CDN, they could wish to move away from this partnership. While this is a possibility, it is sub-optimal for customers who are embracing the multi-cloud and hybrid-cloud paradigms and wish to avoid vendor lock-in.

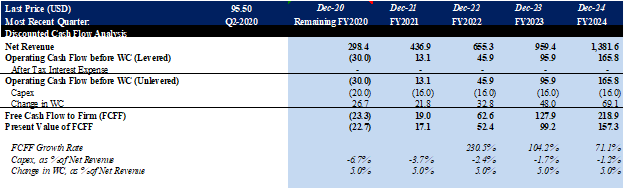

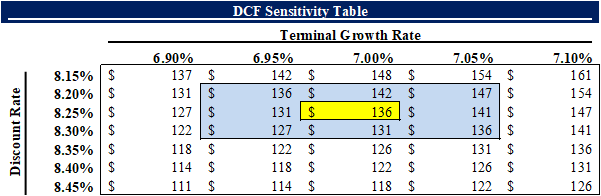

Appendix - Financial Summary and Valuation